Communiqué of the 108th Meeting of the Monetary Council of the Eastern Caribbean Central Bank

1.0 Monetary Stability

The Monetary Council received the Governor’s Report on Monetary, Credit and Financial Conditions in the Eastern Caribbean Currency Union (ECCU). The Report, titled Pushing Ahead Amidst Increasing Global Turmoil and Uncertainty, provided global and ECCU updates on monetary, credit and financial conditions for the first half of the year and assessed their potential impact in the near to medium term. The Governor’s Report indicated that:

a. Both international and regional recovery from the pandemic remains remarkably resilient.

b. Over the medium term, the global economy is expected to underperform relative to the historical trend. Unabating geopolitical conflicts increase uncertainty that threatens global and regional prospects.

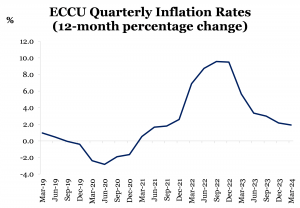

c. Global headline inflation is expected to fall to 5.8 per cent in 2024 from the 6.8 per cent estimated in 2023 (IMF 2024). ECCU inflation has eased significantly, but threats loom from ongoing geo-political issues that are impacting trade.

d. Here in the ECCU, risks are tilted to the downside (notably, the above-average Atlantic Hurricane Season, volatility in revenues from Citizenship by Investment (CBI) Programmes, inflationary pressures and geopolitical risks).

e. The ECCU’s total foreign exchange reserves stand at EC$5.2 billion. The EC currency remains strong, with the backing ratio reaching levels not recorded since 2020 (before the pandemic). The backing ratio is approaching 97.0 per cent (96.64 per cent as at 12 July), up from 95.13 per cent (as at 9 February 2024).

f. Having considered the state of monetary, financial and credit conditions in the ECCU, and on the recommendation of the Governor, the Monetary Council agreed to:

i. Maintain the Minimum Savings Rate at 2.0 per cent; and

ii. Maintain the discount rate at 3.0 per cent for short-term credit and 4.5 per cent for long-term credit.

The Minimum Savings Rate (MSR) is the lowest rate that commercial banks can offer on savings deposits. The Central Bank’s Discount Rate is the rate at which the ECCB lends to governments and commercial banks.

2.0 Financial Stability

The Monetary Council was advised of the following developments in the financial sector:

a. The ECCU banking system remains resilient and stable, with a high degree of liquidity. Monetary aggregates (money supply) continue to expand at a healthy pace, contributing to buoyant levels of liquidity. This is likely attributable to improving economic conditions and job markets.

b. Interest rates have remained low and credit conditions have eased as commercial banks increased lending.

c. Banks are generally well capitalised. Deposits continue to grow.

d. EveryData ECCU Ltd (the Credit Bureau) has signed on 22 of the 25 banks in the ECCU. The go-live date for Antigua and Barbuda, Grenada, Saint Christopher (St Kitts) and Nevis and Saint Vincent and the Grenadines is 01 September 2024. Public education is ongoing throughout the region.

In support of financial stability, the Monetary Council approved the following:

i. Amendments to the Banking Act, 2015;

ii. The Eastern Caribbean Deposit Insurance Corporation Agreement and Bill, to enhance consumer protection;

iii. The legislative framework for the establishment of an Office for Financial Market Conduct and Financial Inclusion within the ECCB, to strengthen financial consumer protection; and

iv. The revised Policy Considerations for Data Protection legislation in the ECCU.

3.0 Fiscal and Debt Sustainability

Fiscal performance has improved in tandem with economic recovery. The Debt to GDP ratio has declined to 75.7 per cent (end of 2023) from its peak of 88.0 per cent at the end of 2020 (first year of the pandemic).

The Monetary Council stands in full solidarity with the Governments and people of Grenada and Saint Vincent and the Grenadines in the wake of Hurricane Beryl. Council ratified the round robin approval of 08 July to grant funding of EC$1.0m each to the Governments of Grenada and Saint Vincent and the Grenadines from Fiscal Reserve Tranche II, to support their relief efforts.

4.0 Growth and Competitiveness

Regional economic growth is forecast to expand by 5.2 per cent in 2024 compared with the provisional 4.5 per cent recorded in 2023.

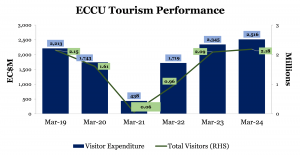

Growth in the ECCU is being propelled by tourism and construction. The latter activity is bolstered by relatively low interest rates within the ECCU, supporting borrowing especially for residential mortgages.

Almost all of the ECCU countries recorded double-digit increases in tourist arrivals for the first quarter of this year (data up to March 2024). The ongoing increase in regional airlift is expected to further boost arrivals intra-regionally.

5.0 Reports received on BAICO, CLICO, ECAMC and ECPCGC

The Monetary Council received Report No 02 of 2024 from the Core Committee on Insurance in respect of efforts to bring resolution for ECCU policyholders of the failed insurance companies – British American Insurance Company Ltd. and CLICO Life Insurance Ltd. Council agreed to continue its efforts to resolve the outstanding matters and facilitate an additional payout to eligible policyholders.

The Monetary Council noted the Report from the Eastern Caribbean Partial Credit Guarantee Corporation (ECPCGC), including ECPCGC’s Financial Report as of 31 May 2024. The ECPCGC aims to support small businesses in the ECCU.

Council also approved the Report on the operations of the Eastern Caribbean Asset Management Corporation (ECAMC).

6.0 Date and Venue of the 109th Meeting of the Monetary Council

Council agreed to the convening, virtually, of the 109th Meeting of the Monetary Council on Friday, 18 October 2024 at 9:00 a.m.

7.0 Participation

Council Members attending the meeting were:

The Honourable Dr Ellis L Webster, Premier and Minister for Finance, Anguilla (Chairman)

The Honourable Gaston Browne, Prime Minister and Minister for Finance, Antigua and Barbuda

The Honourable Lennox Andrews, Minister for Economic Development, Council Alternate for Grenada (virtually)

The Honourable Joseph Easton Farrell, Premier and Minister for Finance, Montserrat

The Honourable Dr Terrance Drew, Prime Minister and Minister for Finance, Saint Christopher (St Kitts) and Nevis

The Honourable Wayne Girard, Minister in the Ministry of Finance, Council Alternate for Saint Lucia

Shermalon Kirby

Eastern Caribbean Central Bank

869-465-2537

info@eccb-centralbank.org

Visit us on social media:

Facebook

X

LinkedIn

YouTube