Emerging Consumer Landscapes in Sub-Saharan Africa

South Africa is poised to achieve a nominal GDP of $401 billion in 2024, overtaking Nigeria as the largest economy in Africa.

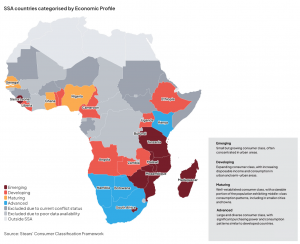

LAGOS, NIGERIA, April 3, 2024 /EINPresswire.com/ -- The economic landscape of Sub-Saharan Africa (SSA) is undergoing a significant shift as South Africa prepares to surpass Nigeria as the largest economy in the region. Amidst this pivotal moment, a report leveraging the Stears Consumer Market Classification Framework and Market Attractiveness Index has been released, offering strategic insights into SSA’s burgeoning consumer markets.The report highlights that 59% of SSA’s consumer potential is distributed across 27 countries, reflecting the region's remarkable economic diversity. While South Africa is poised to achieve a nominal GDP of $401 billion in 2024 (according to IMF projections), other countries such as Cape Verde, Senegal, Ethiopia, and Tanzania are also experiencing promising consumer market growth.

Regarding market maturity, 22% of SSA’s consumer market is classified as ‘Advanced,’ predominantly led by South Africa. This group, including Botswana, Namibia, and Eswatini, outstrips the Sub-Saharan African average GDP per capita by four times, indicating robust economic health and consumer spending.

Contrastingly, a significant portion of SSA’s markets, approximately 44%, are categorised as either ‘Maturing’ or ‘Developing’, representing a combined population of 579 million. These markets, like Nigeria and Ghana, are often characterised by their young demographics, reliance on commodities, and uneven consumer class structures.

Emerging markets, on the other hand, constitute a notable 33% of SSA’s consumer potential, with over half of the world’s low-middle-income countries located in the region. Most of these Emerging markets are in East Africa, accounting for 56%, while the remaining 44% are distributed across Southern and Western Africa.

The analysis emphasises the importance of understanding income variations, which further illuminates the distinct factors driving their consumer markets. It offers a nuanced understanding of the region’s diverse consumer markets, aiding in developing targeted strategies to capitalise on these opportunities. With specific country analyses included, this report helps navigate the complexities of SSA’s consumer markets.

For further information or media inquiries, please contact Abdul Abdulrahim at abdul@stears.co.

Abdul Abdulrahim

Stears

abdul@stears.co

Visit us on social media:

Twitter

LinkedIn