Dallas County Property Tax Valuations

Providing a thorough understanding of the 2022 Dallas County Property Tax Valuations, O'Connor has initiated a comprehensive analysis.

HOUSTON , TEXAS , UNITED STATES , April 17, 2024 /EINPresswire.com/ -- Between 2013 and 2022, Dallas County saw a significant increase in property values, as assessed by the Dallas Central Appraisal District. During this period, the total value of property in the county surged by 113%, soaring from $215 billion to $460 billion. This growth closely mirrors the statewide increase of 135%. Across Texas, the total value of property appraised by appraisal districts skyrocketed from $2.253 trillion in 2013 to $5.296 trillion in 2022.Dallas Central Appraisal District

The Dallas Central Appraisal District, a governmental body, appraises all property in Harris County at least every three years. Governed by a board of directors, they appoint the chief appraiser. Additionally, the district assesses property for taxes, conducts protest hearings, administers exemptions and special valuations, and distributes the final tax roll to all Dallas tax entities.

Dallas County Property Value per Acre

Dallas County demonstrates an impressive property value encompassing 909 square miles and 581,760 acres (equivalent to 640 acres per square mile), it is marginally smaller than the average Texas county, spanning 1,058 square miles. As reported by the Dallas Central Appraisal District in 2022, the total property value stands at a remarkable $460 billion, translating to a substantial value of $673,817 per acre. This significant figure contrasts notably with the statewide average of $30,808 per acre.

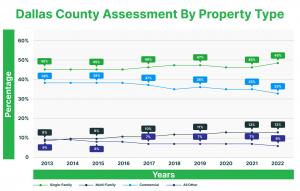

Dallas County Houses ~48% of Total Value

The Dallas Central Appraisal District’s valuation of single-family residences constitutes 48% of Dallas County’s total market worth. This proportion exceeds the statewide norm of approximately 46% for the year 2022. Over the period from 2014 to 2022, the portion of value attributed to homes has risen from I45% to 48%, outpacing the statewide percentages of 41% to 46% of value coming from residential property.

Apartments, Commercial, Business Personal Property and Industrial / Other ~ 48%

The Dallas Central Appraisal District has released statistics for the property tax distribution in Dallas County for 2022. Their numbers indicate that single-family homes comprised 48%, apartments 12%, commercial buildings 33%, and industrial and other properties 6% of the total tax valuation.

Dallas County Property Value $176.8 BB per 1 Million Population

In 2022, the revised valuation of Dallas property stands at $176.8 billion per 1 million population, marking a significant surge from $86.5 billion per million population recorded in 2013. This represents a remarkable 103% increase over nine years, outpacing the growth rate of the Consumer Price Index (CPI). Conversely, the statewide market value per million population for the state registers at $176.3 billion. However, the annual growth rate of tax assessments, at 4.6%, is relatively subdued compared to that observed across Texas.

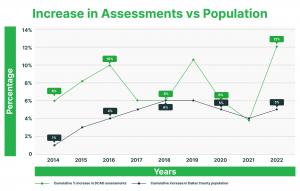

Property Value Grows Faster Than Population

The disparity between the Dallas Central Appraisal District’s substantial growth in increasing the value of taxable property (114%) compared to the modest population growth rate of 9.5% is striking. While real estate values across the United States experienced a significant surge from 2013 to 2022, the market has entered a reset phase since early 2022. Elevated interest rates have contributed to decreased affordability for residential properties and diminished the value of commercial real estate assets.

Transition Period to Slower Property Value Growth

As of October 2023, home prices in Houston and Texas appear stagnant. While home sales have declined, average prices remain steady. However, many potential sellers are deterred by their existing low-interest mortgages, around 3.5% or lower. Acquiring a new mortgage at the current rate of about 7% would be a significant increase for most homeowners.

Erratic Reassessment in 2024

There is a possibility that Texas appraisal districts may opt to significantly increase property values once again. However, the current home sale data, reflecting both sales volume and prices, provides little reassurance. In practice, when sales prices remain relatively stagnant across a metropolitan area, they tend to exhibit a mixed pattern. Certain areas experience higher prices, some witness declines, while others remain stable. It appears probable that the reassessments for 2024 will yield varied outcomes. While some assessments may see increases, it is also likely that some will decrease.

Dallas County Home Price Sale Trends

Home prices in the Dallas area have remained fairly steady compared to the previous year. In September, the average home sale price was approximately $350,000. However, in October, there was a slight decrease in the median home price, which fell by 1.57% to $344,500.

Commercial Property Values Down Due to Higher Interest Rates

Commercial property values are intricately linked to interest rates, notably the 10-year Treasury rate. As interest rates climb, so do capitalization rates, resulting in diminished market values. Despite low rates pre-COVID and during the pandemic until 2021, the subsequent surge in commercial mortgage rates in 2022 and 2023 has precipitated a sharp downturn in commercial property sales and mortgage activity.

This rise in rates has effectively halted activity in the commercial property capital markets, with buyers and sellers grappling with disparate expectations regarding acceptable sales prices. Buyers now demand significantly higher capitalization rates to achieve satisfactory investment returns, leading to downward pressure on sales prices. Consequently, property owners are adopting a wait-and-see approach, refraining from selling unless compelled, as they anticipate stabilization in both interest rates and market conditions.

Dallas County Property Value in Comparison

In 2022, the Dallas Central Appraisal District appraised Dallas County’s property at an impressive $459 billion, underscoring its exceptional value compared to other counties. Travis County closely followed at $428 billion, with Tarrant County at $299 billion, and Bexar County trailing behind at $223 billion.

Are Dallas Central Appraisal District (DCAD) Property Values Reliable?

The Dallas Central Appraisal District (DCAD) encounters a substantial challenge, much like other appraisal districts in Texas. As of 2022, DCAD operates with 102 appraisers tasked with evaluating the value of 844,476 property tax parcels. Typically, DCAD conducts a thorough reassessment of all properties annually. Among the 102 appraisers, the majority focus on on-site data collection for newly constructed properties. Consequently, each appraiser dedicated to assessing property value is responsible for approximately 8,445 tax parcels.

Dallas County Owners Actively Protest Property Taxes

Dallas County property owners demonstrate a greater inclination to file protests compared to property owners statewide in Texas. In 2022, Dallas County property owners contested the value of 18.7% of accounts, whereas the statewide proportion was 12.2%.

In 2022, property tax protests in Dallas County resulted in a reduction of property taxes by more than a billion dollars. Furthermore, these protests lowered the taxable value of property in Dallas County by $43.7 billion, encompassing both informal, ARB, and judicial appeals.

Texas contributes a significant share of property tax savings stemming from property tax protests and judicial appeals. Statewide, the total value reduction amounted to $243 billion in 2022, with Dallas County accounting for 4.4% of the statewide reductions.

Homeowner Tips

Homeowners should ensure they have a homestead exemption for their primary residence. In most instances, this information can be verified on the county appraisal district website. For any questions or concerns regarding homestead exemptions, please don’t hesitate to reach out to us.

Homeowners in Dallas County frequently achieve property tax reductions through informal appeals. Stay tuned for our upcoming blog on Dallas County property taxes, covering protest statistics and comparisons to statewide trends. For complimentary assistance with homestead exemptions, call us at 713-290-9700. We offer no-fee homestead assistance.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube