Returnable Glass Bottle Market Size Expected to Reach USD 9.35 Bn by 2032

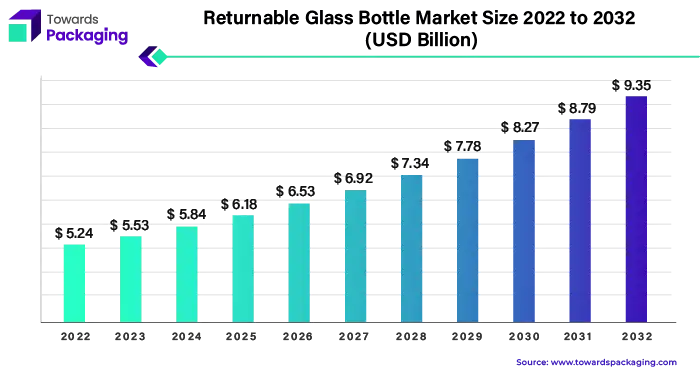

The global returnable glass bottle market size was calculated at USD 5.53 billion in 2023 and is expected to reach around USD 9.35 billion by 2032, expanding at a solid CAGR of 6% from 2023 to 2032.

/EIN News/ -- Ottawa, Aug. 13, 2024 (GLOBE NEWSWIRE) -- The global returnable glass bottle market size is projected to surpass around USD 9.35 billion by 2032 increasing from USD 5.84 billion in 2024, a study published by Towards Packaging a sister firm of Precedence Statistics.

The returnable glass bottle market is experiencing significant growth due to increasing environmental concerns, rising consumer preference for sustainable packaging, and supportive government regulations promoting the use of returnable packaging solutions.

Get a comprehensive Returnable Glass Bottles Market Size, Companies, Share free sample: https://www.towardspackaging.com/personalized-scope/5164

Key Takeaways

- Asia Pacific dominated the returnable glass bottle market in 2023

- North America is observed to be the fastest growing region during the forecast period.

- The beverage industry is the primary end-user in the market.

- Alcoholic beverages are the main application in the returnable glass market.

- By Manufacturing Process, the blown segment dominated the market.

A returnable glass bottle is a type of packaging that can be used multiple times. After the contents are consumed, the bottle is returned to the manufacturer or a collection point, cleaned, sterilized, and refilled for reuse. This process reduces waste and the need for producing new bottles, making it an eco-friendly packaging option.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

The returnable glass bottle market refers to the industry that deals with the production, distribution, and use of these reusable bottles. This market is growing as more people and companies look for sustainable packaging solutions to reduce their environmental impact. It includes a range of products used in beverages, dairy products, and other consumer goods. The market's growth is driven by increasing environmental awareness, government regulations encouraging sustainable practices, and the rising consumer preference for eco-friendly products.

Returnable Glass Bottle Market at a Glance

The Returnable Glass Bottle Market is witnessing significant growth as industries and consumers alike shift towards more sustainable packaging solutions. These bottles, known for their durability and environmental benefits, are becoming a popular choice, particularly in the beverage industry.

One of the primary drivers of this market is the increasing consumer awareness about environmental issues. Glass is 100% recyclable and can be reused multiple times without losing its quality, making it an ideal choice for those looking to reduce their carbon footprint. Moreover, many governments are implementing stringent regulations to reduce plastic waste, further boosting the demand for returnable glass bottles.

Get a customized Returnable Glass Bottle Market report designed according to your preferences: https://www.towardspackaging.com/customization/5164

The Returnable Glass Bottle Market is expanding as sustainability becomes a key consideration for consumers and businesses. With the combined benefits of recyclability, aesthetic appeal, and technological advancements, glass bottles are set to play a pivotal role in the future of packaging.

Environmental Concerns Driving the Returnable Glass Bottle Market

One of the key environmental benefits of returnable glass bottles is the significant reduction in packaging waste. Unlike single-use plastic bottles, which contribute to massive amounts of waste in landfills and oceans, returnable glass bottles can be reused multiple times. This process greatly minimizes the volume of waste generated. For example, in Germany, the implementation of a deposit return scheme for glass bottles has drastically reduced the country's packaging waste, leading to a cleaner environment and better waste management practices.

Reusing glass bottles conserves vital resources. The energy and raw materials required to produce new glass bottles are considerable, but when these bottles are returned, cleaned, and reused, the need for new materials decreases. This conservation effort not only saves energy but also preserves natural resources. A notable example is the Swedish brewery, Spendrups, which has reported saving thousands of tons of glass annually by using returnable bottles, highlighting the practical benefits of resource conservation.

- In recent years, several companies and countries have taken substantial steps to enhance the returnable glass bottle system. For instance, in 2023, the Canadian province of British Columbia expanded its beverage container recycling program to include more types of returnable glass bottles. This initiative is expected to divert millions of bottles from landfills, further underscoring the environmental benefits of this approach. Additionally, Heineken has launched a global campaign promoting the use of returnable glass bottles, emphasizing their commitment to sustainability and the reduction of environmental impact.

Regulatory Support

Government policies aimed at promoting recycling and reducing waste are playing a crucial role in boosting the returnable glass bottle market. One significant example of such policies is the implementation of deposit return systems (DRS). These systems encourage consumers to return their used bottles by offering a small refund for each bottle returned. This not only helps in reducing litter but also ensures that the glass bottles are reused multiple times.

A notable development in this area is the recent expansion of DRS in Germany. The country has one of the most effective bottle deposit schemes in the world, with a return rate of over 98% for glass bottles. This high return rate is a testament to how effective such regulations can be in promoting the use of returnable glass bottles. Additionally, the European Union has set ambitious recycling targets, aiming for 75% of all glass packaging to be recycled by 2030. These targets are encouraging member countries to adopt or enhance their bottle return programs.

- In the United States, several states have implemented "bottle bills," which are laws that require deposits on beverage containers to encourage recycling. States like Oregon and Michigan have seen significant success with their bottle bills, reporting high return rates for glass bottles. For instance, Michigan's bottle bill boasts a return rate of nearly 90%.

Restraint, Operational Challenges

One of the significant hurdles for the returnable glass bottle market is the fragility of glass. During transportation, handling, and the cleaning process, glass bottles are prone to breaking. This not only increases operational costs but also reduces the number of times a bottle can be reused. For instance, breweries that use returnable glass bottles often report higher breakage rates, leading to frequent replacements. To mitigate this, some companies are exploring more robust bottle designs, but this solution is still in development and may not be cost-effective for all.

Cleaning and Sanitation: Ensuring that returned bottles are thoroughly cleaned and sanitized is crucial to prevent contamination. However, this process can be labor-intensive and costly. The need for rigorous cleaning standards means investing in advanced cleaning equipment and ensuring compliance with health regulations. For example, in the dairy industry, companies like Straus Family Creamery have invested heavily in sophisticated bottle washing systems to maintain high hygiene standards, which adds to their operational costs.

- For instance, in 2023, Heineken launched a pilot program in the Netherlands focused on improving the efficiency of their returnable bottle operations. This program includes innovations in bottle design to reduce breakage and investment in state-of-the-art cleaning facilities. Additionally, technological advancements in tracking and logistics management are being explored to streamline the reverse logistics process, making it more cost-effective and efficient.

Upcoming Opportunity, Premiumization and Niche Markets

The surge in popularity of craft beers, wines, and spirits is creating a significant opportunity for premium returnable glass packaging. Craft beverage producers often emphasize quality, uniqueness, and sustainability, making returnable glass bottles an attractive option. These bottles not only enhance the aesthetic appeal of the products but also align with the eco-conscious values of craft beverage consumers. For example, the craft beer industry in the United States has seen breweries like New Belgium Brewing and Sierra Nevada Brewing Company adopt returnable glass bottles as part of their sustainability initiatives. This trend is supported by the growing consumer preference for environmentally friendly packaging.

Luxury brands can leverage returnable glass bottles to enhance their product image and sustainability credentials. High-end products often rely on premium packaging to convey exclusivity and quality. By adopting returnable glass bottles, luxury brands can differentiate themselves in the market while promoting a sustainable image. For instance, premium spirit brands such as Absolut Vodka have introduced returnable glass bottle programs to highlight their commitment to sustainability. This move not only attracts environmentally conscious consumers but also adds a unique selling point that sets them apart from competitors.

Asia Pacific is Holds the Largest Market Share in Returnable Glass Bottle Market

The Asia Pacific region dominates the returnable glass bottle market, primarily due to its significant production capabilities and widespread use of lightweight glass bottles. Countries like China and Japan are top exporters of glass, contributing to the region's robust container glass industry. The alcoholic beverages sector leads the usage of returnable glass bottles in this region, driven by high production demands and rising feedstock prices. Lightweight glass manufacturing techniques and growing environmental consciousness among consumers are key drivers in this market.

- Sapporo Brewery has been pioneering lightweight glass bottle production in Japan.

- PGP Glass Ceylon PLC in Sri Lanka, in collaboration with HEINEKEN Lanka, launched a signature reusable 625ml bottle in June 2023.

North America on to Grow at a Significant Growth Rate

North America is increasingly adopting returnable glass bottles as part of a broader sustainability movement. The demand for refillable glass bottles is growing, fueled by environmental concerns and the desire to reduce single-use plastic packaging. However, challenges such as supply shortages and low recycling rates (only 31% in the USA) persist. The beverage industry, particularly in the USA and Canada, is focusing on improving recycling techniques and promoting reusable packaging to reduce environmental impact.

- The Coca-Cola Company announced a goal to reach 25% of its product volume through innovative reusable packaging by 2030.

- Heineken invested in a water reclamation facility and solar power plant at its Sedibeng brewery, reducing carbon emissions by 30%.

Europe is at the Forefront of the Returnable Glass Bottle Market

Europe is at the forefront of the returnable glass bottle market, driven by stringent environmental regulations and consumer demand for sustainable packaging. The region's beverage industry, especially in countries like Germany and France, extensively uses returnable glass bottles. The European Union's regulations on reuse targets are pushing companies to adopt sustainable practices and innovate in glass bottle manufacturing.

- Coca-Cola Europacific Partners launched 250ml returnable glass bottles for its brands in the hospitality sector.

- Vetropack introduced a standard 0.33-litre returnable bottle for the Austrian brewing industry.

By Manufacturing Process, the Blown Segment is Observed to Grow as a Leader

In the returnable glass bottle market, the blown manufacturing process stands out as the dominant method. This process involves inflating molten glass into molds to form bottles. It's popular because it allows for a wide variety of shapes and sizes, making it highly versatile for different industries.

By Application, the Alcoholic Segment to Sustain as a Leader

Alcoholic beverages are the primary application for returnable glass bottles. These bottles are favored for their ability to preserve the quality and flavor of beverages like beer, wine, and spirits. The durability and reusability of glass bottles make them an ideal choice for these products.

By End Use, the Beverages Segment to be the Largest Segment

Within the end-use segment, the beverage industry is the largest user of returnable glass bottles. This includes both alcoholic and non-alcoholic drinks. The trend towards sustainability and reducing plastic waste has led many beverage companies to opt for glass bottles that can be returned, cleaned, and refilled multiple times.

More Insights in Towards Packaging

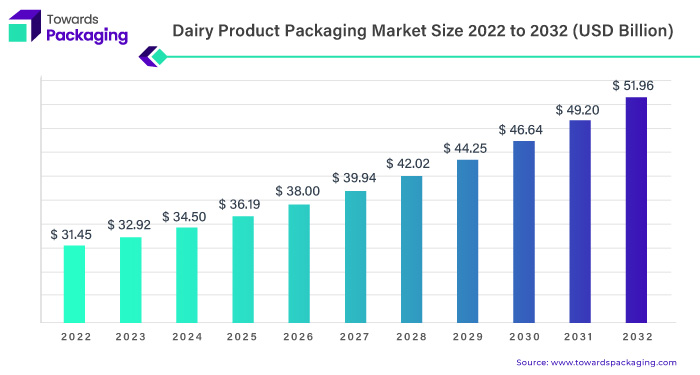

Dairy Product Packaging Market Size, Share and Companies

The global dairy product packaging market size forecasted to expand from USD 31.45 billion in 2022 to achieve an approximation USD 51.96 billion by 2032 at a growing CAGR of 5.2% CAGR between 2023 and 2032.

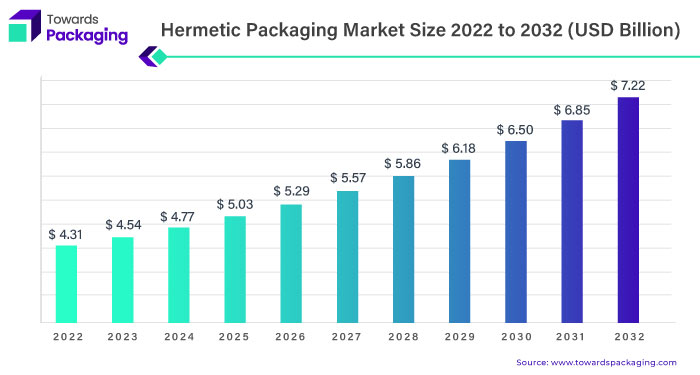

Hermetic Packaging Market Size, Share and Companies

The global hermetic packaging market size calculated to go up from USD 4.31 billion in 2022 to accomplish a supposed USD 7.22 billion by 2032 at a growing CAGR of 5.3% CAGR between 2023 and 2032.

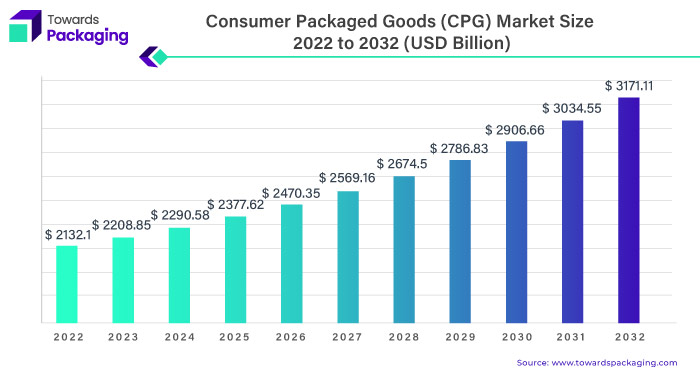

Consumer Packaged Goods (CPG) Market Size and Share

The global consumer packaged goods (CPG) market size presumed to grow from USD 2,132.1 billion in 2022 to realize an expected USD 3,171.11 billion by 2032 at a growing CAGR of 4.1% CAGR between 2023 and 2032.

- The global thin wall packaging market size speculated to escalate from USD 41.48 billion in 2022 to fulfill a guesstimated USD 76.77 billion by 2032 at a growing CAGR of 6.4% CAGR between 2023 and 2032.

- The global dunnage packaging market size envisioned to advance from USD 3.8 billion in 2022 to reach a conjectured USD 6.52 billion by 2032 at a growing CAGR of 5.6% CAGR between 2023 and 2032.

- The global stick packaging market size is envisaged to surge from USD 325.21 million in 2022 to acquire a anticipated USD 547.63 million by 2032, at a growing 5.4% CAGR between 2023 and 2032.

- The global retail ready packaging market size prognosticated to elevate from USD 66.63 billion in 2022 to secure a forecasted USD 115.44 billion by 2032, growing at a 5.7% CAGR between 2023 and 2032.

- The global blister packaging market size is predicted to climb from USD 25.63 billion in 2022 to hit a presumed USD 47.44 billion by 2032, growing at a 6.4% CAGR between 2023 and 2032.

- The global cold chain packaging refrigerants market size expected to increase from USD 1.61 billion in 2022 to obtain a projected USD 3.36 billion by 2032, registered at a 7.7% CAGR between 2023 and 2032.

- The global packaging adhesive market size anticipated to rise from USD 12.54 billion in 2022 to attain a calculated USD 23 billion by 2032, registered at a 6.3% CAGR between 2023 and 2032.

Key Market Players

- Coca-Cola

- Revino

- Sidel

- Vetropack

- Markem-Image

- Goya

- Green Giant

- Cento

- Del Monte Foods Inc.

- Nature's Greatest Foods

- Linx Printing Technologies

- Whole Foods Market

- Rosarita

- Old El Paso

- Reese

- Farmer's Market

Recent Developments

- In 2023, Vetropack, a leader in glass packaging, launched an innovative lightweight returnable glass bottle. This design aims to minimize the environmental footprint of packaging and facilitate the return and reuse of bottles by consumers. Its reduced weight not only makes it more convenient for users but also lessens transportation-related carbon emissions.

- In 2023, Coca-Cola HBC, a major bottler for Coca-Cola products, inaugurated a state-of-the-art high-speed returnable glass bottling line in Austria. This advanced facility features the latest technology for more rapid and efficient production of returnable glass bottles. The initiative aligns with Coca-Cola HBC's sustainability goals by addressing the rising need for eco-friendly packaging and decreasing environmental impacts. These bottles, which can be reused several times, offer a more sustainable alternative to single-use plastic.

- In 2023, Revino, a prominent wine packaging firm, introduced a groundbreaking refillable glass bottle reuse system. This new system aims to significantly lessen the environmental effects of wine packaging by encouraging the reuse of glass bottles. By establishing a closed-loop supply chain, the system enables bottles to be collected, sanitized, and reused multiple times, thereby reducing waste and cutting carbon emissions associated with single-use bottles.

Returnable Glass Bottle Market TOC

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Overview

-

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

-

Value chain analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

-

Trends

- Market Trends

- Technological Trends

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

-

Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

Global Returnable Glass Bottle Market Assessment

- Overview

-

Global Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Manufacturing Process Type (2021 – 2032)

- Blown

- Tubing

-

Global Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Application Type (2021 – 2032)

- Alcoholic

- Non-Alcoholic

-

Global Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2032)

- Beverage

- Food

- Pharmaceutical

- Cosmetics

- Personal Care

- Industrial

- Household

- Others

-

Global Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Region Type (2021 – 2032)

- Asia Pacific

- North America

- Europe

- LAMEA

Asia Pacific Returnable Glass Bottle Market Assessment

- Overview

-

Asia Pacific Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Manufacturing Process Type (2021 – 2032)

- Blown

- Tubing

-

Asia Pacific Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Application Type (2021 – 2032)

- Alcoholic

- Non-Alcoholic

-

Asia Pacific Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2032)

- Beverage

- Food

- Pharmaceutical

- Cosmetics

- Personal Care

- Industrial

- Household

- Others

North America Returnable Glass Bottle Market Assessment

- Overview

-

North America Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Manufacturing Process Type (2021 – 2032)

- Blown

- Tubing

-

North America Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Application Type (2021 – 2032)

- Alcoholic

- Non-Alcoholic

-

North America Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2032)

- Beverage

- Food

- Pharmaceutical

- Cosmetics

- Personal Care

- Industrial

- Household

- Others

Europe Returnable Glass Bottle Market Assessment

- Overview

-

Europe Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Manufacturing Process Type (2021 – 2032)

- Blown

- Tubing

-

Europe Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Application Type (2021 – 2032)

- Alcoholic

- Non-Alcoholic

-

Europe Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2032)

- Beverage

- Food

- Pharmaceutical

- Cosmetics

- Personal Care

- Industrial

- Household

- Others

LAMEA Returnable Glass Bottle Market Assessment

- Overview

-

LAMEA Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Manufacturing Process Type (2021 – 2032)

- Blown

- Tubing

-

LAMEA Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By Application Type (2021 – 2032)

- Alcoholic

- Non-Alcoholic

-

LAMEA Returnable Glass Bottle Market Size Value (US$) and Volume (Billion Tons), By End Use Type (2021 – 2032)

- Beverage

- Food

- Pharmaceutical

- Cosmetics

- Personal Care

- Industrial

- Household

- Others

Company Profile

- Coca-Cola

- Company Overview

- Geographic Footprints

- Financial Performance

- Product Portfolio

- SWOT Analysis

- R&D Efforts

- Recent Developments & Strategic Collaborations

- Product Launch/M&A/Technical Collaboration

- Revino

- Sidel

- Vetropack

- Markem-Image

- Goya

- Green Giant

- Cento

- Del Monte Foods Inc.

- Nature's Greatest Foods

- Linx Printing Technologies

- Whole Foods Market

- Rosarita

- Old El Paso

- Reese

- Farmer’s Market Foods

- Domino Printing Sciences

- Great Value

- Native Forest

- 365 by WFM

- Rotel

- Paul Leibinger GmbH & Co. KG

- Libby's

- Good & Gather

Conclusion & Recommendations

Act Now and Get Your Returnable Glass Bottle Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5164

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/