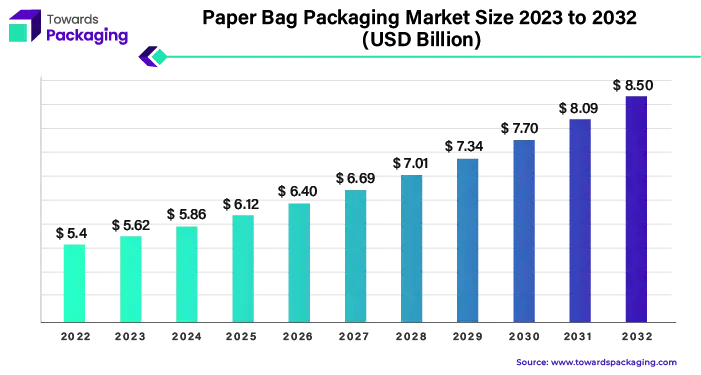

Paper Bag Packaging Market Size Expected to Reach USD 8.50 Bn by 2032

The global paper bag packaging market size is calculated at USD 5.86 billion in 2024 and is expected to reach around USD 8.50 billion by 2032, expanding at a CAGR of 4.7% from 2024 to 2032.

/EIN News/ -- Ottawa, July 31, 2024 (GLOBE NEWSWIRE) -- The global paper bag packaging market size was valued at USD 5.62 billion in 2023 and is predicted to hit around USD 7.70 billion by 2030, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive Paper Bag Packaging Market Size, Companies, Share free sample: https://www.towardspackaging.com/personalized-scope/5172

Key takeaways

- Asia Pacific led the market with the largest share in 2023.

- Europe holds the second-largest share in 2023.

- North America is experiencing rapid growth due to rising consumer awareness of plastic pollution.

- By product type, the flat bottom bags segment dominated the market in 2023.

- By material, the brown kraft paper segment held the largest share of the market in 2023.

- By end-use, the food and beverage segment held the largest share of the market in 2023.

The paper bag packaging market is an industry dedicated to producing bags made from paper. These bags are commonly used for packaging various products such as groceries, clothing, and food items. With a growing emphasis on sustainability and environmental friendliness, paper bags have become a popular alternative to plastic bags. In recent years, there has been a significant shift towards using paper bags due to the increasing awareness of the harmful effects of plastic on the environment. Governments and regulatory bodies across the globe are implementing stricter regulations on plastic usage, encouraging businesses to adopt more eco-friendly packaging solutions. This shift is driving the growth of the paper bag packaging market.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Paper bag packaging market at a Glance

The paper bag packaging market has been experiencing significant growth, driven largely by the increasing demand for sustainable and environmentally friendly packaging solutions. Several factors contribute to this growth. Firstly, there's a rising consumer awareness and preference for eco-friendly products, which has led to a shift from plastic to paper packaging. Paper bags are not only recyclable and biodegradable but also consume less energy during production compared to plastic bags. This makes them an attractive option for both consumers and businesses looking to reduce their environmental footprint.

The market is segmented based on product types such as flat bottom, sewn open mouth, pinched bottom open mouth, pasted valve, and pasted open mouth bags. Each type caters to different needs and industries, ranging from food and beverage to cosmetics and personal care, retail, agriculture, building and construction, and chemicals.

The paper bag packaging market is evolving with innovations in design and functionality, making them more durable and versatile. Leading companies like International Paper, Smurfit Kappa, and Mondi are continuously investing in new technologies to enhance product quality and sustainability. As the world continues to prioritize environmental conservation, the paper bag packaging market is poised for continued growth and innovation.

Get a customized Paper Bag Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5172

Sustainability Concerns Driving the Paper Bag Packaging Market

In recent years, there has been a growing awareness among consumers about the environmental impact of plastic packaging. Many people are now actively seeking alternatives that are less harmful to the planet. One such alternative that has gained significant traction is paper bag packaging.

Paper bags offer a major advantage over plastic ones: they are biodegradable and recyclable. This means that after their use, paper bags can break down naturally without leaving harmful residues in the environment, or they can be recycled and transformed into new paper products. This eco-friendly characteristic of paper bags is a key reason behind the shift in consumer preferences.

-

For instance, a study conducted by the European Paper Packaging Alliance in 2023 revealed that more than 70% of consumers in Europe prefer paper packaging over plastic due to environmental concerns. This shift is not just limited to Europe; similar trends are being observed worldwide. In the United States, many cities have introduced regulations banning single-use plastic bags, which has further boosted the demand for paper bags.

Recent developments in the sector underscore this growing trend. Major retail chains, like IKEA and H&M, have announced their commitment to phase out plastic bags in favor of paper alternatives. In 2022, H&M reported a significant reduction in plastic waste by switching to paper bags across all its stores globally. Similarly, McDonald's has been testing paper-based packaging for its takeout meals, aiming to reduce its plastic footprint.

Growing Demand for Packaged Goods to Support the Market’s Growth

The demand for packaged goods is on the rise across the globe. This surge is primarily fueled by several factors, including urbanization, increasingly busy lifestyles, and higher disposable incomes. As more people move to urban areas, their need for convenient, ready-to-use products grows, leading to a higher consumption of packaged goods. Additionally, busy schedules and hectic routines have led many consumers to favor products that are easy to use and store, further boosting the demand for packaging solutions.

A clear example of this trend can be seen in the food and beverage industry. With more consumers seeking on-the-go snacks and beverages, the need for reliable and sustainable packaging solutions is paramount. Paper bags offer a viable solution here, as they are not only durable but also environmentally friendly. Brands like McDonald's have shifted towards paper-based 1 for their takeaway items, responding to both consumer demand and sustainability goals.

-

Recent developments in the sector highlight the growing emphasis on sustainability. For instance, in 2023, Nestlé announced its commitment to transition its confectionery packaging to recyclable paper, aiming to reduce its plastic footprint. This move reflects the broader industry trend towards adopting eco-friendly packaging materials to meet consumer expectations and regulatory requirements.

Cost and Durability Challenges in Paper Bag Packaging

Paper bags often come with a higher price tag compared to plastic bags. This cost difference arises from the raw materials and production processes involved. Paper, especially high-quality and sustainably sourced paper, can be expensive. Additionally, the manufacturing process for paper bags tends to be more labor-intensive and requires more energy compared to plastic bags.

For example, a small retail business looking to minimize expenses might find the higher cost of paper bags a significant hurdle. While large corporations like Starbucks can absorb these costs and even market their sustainability efforts as a selling point, smaller businesses might struggle with the increased expenses. In 2023, a study revealed that small businesses in the retail sector reported a 20-30% increase in packaging costs after switching from plastic to paper bags. This financial burden can deter some businesses from making the switch, despite the environmental benefits.

In addition to cost, durability is a major concern. Paper bags, though improving in quality, generally lack the robustness of plastic bags. They are more susceptible to moisture, tearing, and punctures, which can limit their application for certain types of packaging. For example, heavy-duty packaging or items that need protection from the elements, such as groceries with frozen items, are less suited for paper bags.

A real-world example can be seen in the grocery sector. Supermarkets have traditionally relied on plastic bags for their strength and ability to handle heavy loads. While some grocery chains have introduced paper bags, they often have to double-bag items to ensure they don't tear or break, which increases both the cost and the environmental footprint of paper bag usage. In 2022, a major grocery chain in the UK, Tesco, reported issues with paper bags tearing under the weight of heavy items, leading to customer complaints and a temporary return to plastic bags for certain products.

Focus on Functionality, Enhancing Paper Bags for Specialized Applications

One of the primary opportunities lies in developing paper bags with enhanced strength to handle heavy-duty packaging requirements. Innovations in material science have led to the creation of stronger, more resilient paper products. For instance, some companies are exploring the use of reinforced paper with added fibers or multiple layers to increase durability. A notable example is Mondi Group, which has introduced a new range of paper bags designed to carry heavier loads without tearing, thereby expanding the usability of paper bags in sectors like construction and agriculture.

The market is already seeing practical applications of these innovations. For example, in 2023, a collaboration between a leading food delivery service and a packaging manufacturer resulted in the development of insulated paper bags specifically for hot and cold food items. This collaboration not only addressed the need for better temperature control but also catered to the growing consumer demand for sustainable packaging options.

Similarly, the use of tamper-evident features is gaining traction in the pharmaceutical industry. A recent case study highlighted a pharmaceutical company that adopted tamper-evident paper bags for its home delivery service, ensuring that medications reach consumers securely and without any risk of tampering.

Asia Pacific, to Sustain as a Leader in the Market

Asia Pacific led the paper bag packaging market in 2023, driven by rapid industrialization, urbanization, and a rising awareness of environmental sustainability. Countries like China, India, Japan, Australia, and Indonesia are key players in this market. China is a major contributor due to its fast placed urbanization and industrialization, leading to a significant demand for sustainable packaging solutions like paper bags.

India is also witnessing sustainable growth in this market. The country’s focus on reducing plastic pollution has led to increased adoption of paper bags for instance, in January 2024, ITC foods launched Sunfeast Farmlite Digestive Biscuit Family pack in 100% paper bag packaging, aiming to reduce plastic usage and promote sustainable consumer choices. This shift is further supported by government regulations and consumer awareness about the environmental benefits of paper bags.

Europe Holds a Prominent Share of the Paper Bag Packaging Market

Europe holds the second largest market share in the paper bag packaging industry, driven by a strong emphasis on environmental sustainability and stringent government regulations promoting eco-friendly packaging solutions. Countries like Germany, France, and Spain are at the forefront of this trend. Europe’s significant paper production capacity, which reached 74.3 million tons in 2023, supports the steady supply and growth of the paper, bag market.

-

In April 2022, Mondi Group acquired paper bag converting lines from Lafarge Cement Egypt’s subsidiaries, emphasizing the strategic importance of paper packaging in Europe.

North America to Grow at a Rapid Pace

North America, particularly The United States and Canada, is experiencing a rising demand for paper bags as an eco-friendly alternative to plastic. This demand is driven by increasing consumer awareness of plastic pollution and stringent government regulations on single use plastic. The U.S. Saw a significant rise in the consumption of brown and kraft papers, amounting to 2.7 million tons in 2023. Canada plays a crucial role in the supply chain, being a major exporter of unbleached packaging paper, a key raw material for paperbacks.

-

For instance, in April 2022 Kari-Out LLC Announced plans to acquire paper bags USA, highlighting the regions focus on expanding paperback production and reducing plastic use.

By Product, the Flat Bottom Bags Segment Held the Largest Share of the Market in 2023.

Flat bottom bags are revolutionizing the paper bag packaging market due to their practical designs. They make carrying large quantities easier and sand tall and stable on store shelves. This unique structure not only saves packaging materials but also enhances the visual appeal and shelf presence of products and making them a popular choice across various industries.

By Material, the Brown Kraft Segment Led the Market

Brown kraft paper dominates due to its eco-friendly nature. Made from renewable wood pulp and often incorporating recycled materials, brown Kraft paper bags are strong, durable, and compostable. Their natural brown color appeals to environmentally conscious consumers and businesses, driving their popularity in the market.

By Thickness, the Greater than 3 Ply Segment Led the Market in 2023

Paper bags with a thickness greater than 3 ply preferred for their durability and strength. These bags can carry heavier items and withstand rough handling, making them ideal for industrial and commercial use. Their robust construction ensures the safe transport of goods, boosting their demand. In August 2022, McDonald’s Corp., Chicago, has informed public recently that the business of the company has almost reached its goal that all of the paper food packaging in the restaurants is recycled or cooked in the sustainable fiber.

By End use, the Food and Beverage Segment Dominated the Market in 2023

The food and beverage industry in the largest consumer of paper bags. These bags are ideal for packaging a variety of products like rice, coffee, and snacks, providing a sustainable alternative to plastic. The industry’s shift towards eco-friendly packaging solutions has significantly driven the growth of paper bags in this segment. In July 2023, Shenso dawns over India showing jiangsu fangbang paper bag making machines. Shenso that was a joint between the companies situated in India’s North capital region (NCR) and their head office in Delhi-NCR.

Major Breakthroughs in the Paper Bag Packaging Market

- In April 2024, International Paper down with a £5.8 billion acquisition for the corrugated giant of DS Smith, which seemingly had Mondi out. As per reports, DS Smith was believed to have received suggestion from International Paper (IP) and Mondi as well.

- In January 2024, Smurfit Kappa decided to invest EUR 54 thousand to double the production of Ibi Bag-in-Box’s plant in Alicante, Spain.

- In April 2022, the Mondi Paper Bags plastics facility, which is part of Mondi Group, a firm dealing with packaging and paper, acquired a paper bag converting plant from National Bag.

- In June 2023 records, Novolex unveils sustainable as well as recyclable food packaging containers that have cost PCR of up to 10%.

More Insights in Towards Packaging

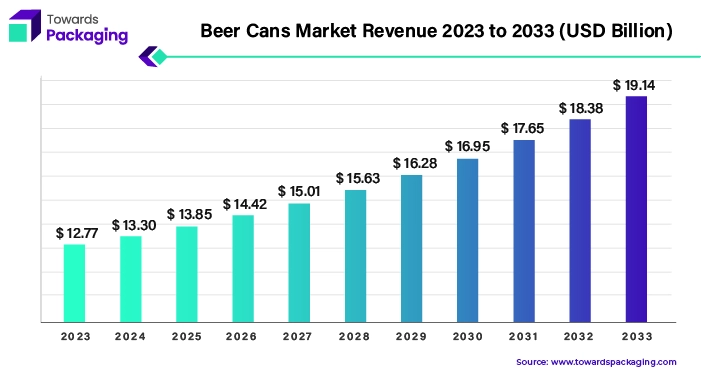

Beer Cans Market Size, Analysis and Regional Insight 2023-2033

The global beer cans market size reached USD 12.77 billion in 2023 and is projected to hit around USD 19.14 billion by 2033, expanding at a CAGR of 4.13% during the forecast period from 2024 to 2033.

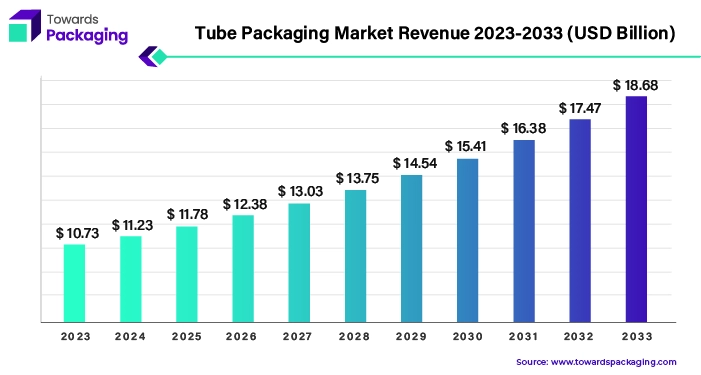

Tube Packaging Market Size (USD 18.68 Bn) by 2033

The global tube packaging market size is estimated to reach USD 18.68 billion by 2033, up from USD 10.73 billion in 2023, at a compound annual growth rate (CAGR) of 5.82% from 2024 to 2033.

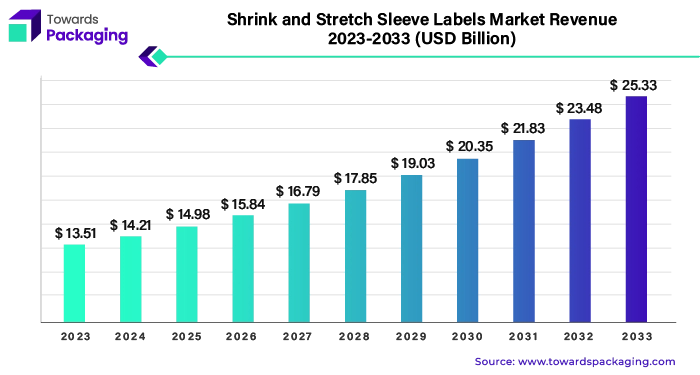

Shrink and Stretch Sleeve Labels Market Size, Growth Rate, Report

The global shrink and stretch sleeve labels market size is estimated to reach USD 25.33 billion by 2033, up from USD 13.51 billion in 2023, at a compound annual growth rate (CAGR) of 6.63% from 2024 to 2033.

- The global barrier films packaging market size is estimated to reach USD 57.74 billion by 2033, up from USD 32.67 billion in 2023, at a compound annual growth rate (CAGR) of 5.99% from 2024 to 2033.

- The global caps and closure market size is estimated to reach USD 129.61 billion by 2033, up from USD 76.52 billion in 2023, at a compound annual growth rate (CAGR) of 5.52% from 2024 to 2033.

- The global e-commerce flexible packaging market size is estimated to reach USD 72.45 billion by 2033, up from USD 32.51 billion in 2023, at a compound annual growth rate (CAGR) of 8.50% from 2024 to 2033.

- The global pouch packaging market size is estimated to reach USD 66.96 billion by 2033, up from USD 41.35 billion in 2023, at a compound annual growth rate (CAGR) of 5.04% from 2024 to 2033.

- The global security printing services market size is estimated to reach USD 46.09 billion by 2033, up from USD 30.48 billion in 2023, at a compound annual growth rate (CAGR) of 4.30% from 2024 to 2033.

- The global labeling machine market size is estimated to reach USD 4.00 billion by 2033, up from USD 2.79 billion in 2023, at a compound annual growth rate (CAGR) of 3.84%.

- The global packaging services market size forecasted to secure USD 48.37 billion by 2033, increase from USD 116.25 billion in 2023, at a compound annual growth rate (CAGR) of 9.34% from 2023 to 2033.

Paper Bag Packaging Market TOC

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Overview

-

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

-

Value chain analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

-

Trends

- Market Trends

- Technological Trends

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

-

Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

Global Paper Bag Packaging Market Assessment

- Overview

-

Global Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flat Bottom

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

-

Global Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Brown Kraft

- White Kraft

-

Global Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Thickness (2021 – 2033)

- 1 ply

- 2 ply

- 3 ply

- Greater than 3 ply

-

Global Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use (2021 – 2033)

- Food & Beverage

- Cosmetics & Personal Care

- Retail

- Agriculture & Allied Industries

- Building & Construction

- Chemicals

- Others

-

Global Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Region (2021 – 2033)

- Asia Pacific

- Europe

- North America

- LAMEA

Asia Pacific Paper Bag Packaging Market Assessment

- Overview

-

Asia Pacific Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flat Bottom

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

-

Asia Pacific Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Brown Kraft

- White Kraft

-

Asia Pacific Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Thickness (2021 – 2033)

- 1 ply

- 2 ply

- 3 ply

- Greater than 3 ply

-

Asia Pacific Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use (2021 – 2033)

- Food & Beverage

- Cosmetics & Personal Care

- Retail

- Agriculture & Allied Industries

- Building & Construction

- Chemicals

- Others

Europe Paper Bag Packaging Market Assessment

- Overview

-

Europe Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flat Bottom

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

-

Europe Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Brown Kraft

- White Kraft

-

Europe Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Thickness (2021 – 2033)

- 1 ply

- 2 ply

- 3 ply

- Greater than 3 ply

-

Europe Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use (2021 – 2033)

- Food & Beverage

- Cosmetics & Personal Care

- Retail

- Agriculture & Allied Industries

- Building & Construction

- Chemicals

- Others

North America Paper Bag Packaging Market Assessment

- Overview

-

North America Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flat Bottom

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

-

North America Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Brown Kraft

- White Kraft

-

North America Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Thickness (2021 – 2033)

- 1 ply

- 2 ply

- 3 ply

- Greater than 3 ply

-

North America Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use (2021 – 2033)

- Food & Beverage

- Cosmetics & Personal Care

- Retail

- Agriculture & Allied Industries

- Building & Construction

- Chemicals

- Others

LAMEA Paper Bag Packaging Market Assessment

- Overview

-

LAMEA Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flat Bottom

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

-

LAMEA Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Brown Kraft

- White Kraft

-

LAMEA Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By Thickness (2021 – 2033)

- 1 ply

- 2 ply

- 3 ply

- Greater than 3 ply

-

LAMEA Paper Bag Packaging Market Size Value (US$) and Volume (Billion Tons), By End Use (2021 – 2033)

- Food & Beverage

- Cosmetics & Personal Care

- Retail

- Agriculture & Allied Industries

- Building & Construction

- Chemicals

- Others

Company Profile

- International Paper Company

- Company Overview

- Geographic Footprints

- Financial Performance

- Product Portfolio

- SWOT Analysis

- R&D Efforts

- Recent Developments & Strategic Collaborations

- Product Launch/M&A/Technical Collaboration

- Smurfit Kappa Group Plc

- Mondi Plc

- Novolex Holdings Inc.

- Langston Companies

- Primepac Industrial Limited

- Ecobags NZ Source

- Ronpak

- Welton Bibby and Baron Limited

- Prompac LLC

- United Bag Inc.

- Genpak Flexible

- Global-Pak Inc.

- York Paper Company Limited

- PaperBag Limited

- JohnPac Inc.

Conclusion & Recommendations

Act Now and Get Your Paper Bag Packaging Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5172

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/