Asset Management Market Size Expected to Reach USD 10,478.93 Billion by 2033

The global asset management market size is calculated at USD 685.09 billion in 2024 and is expected to reach around USD 10,478.93 billion by 2033, registering a double-digit CAGR of 35.4% from 2024 to 2033.

/EIN News/ -- Ottawa, July 15, 2024 (GLOBE NEWSWIRE) -- The global asset management market size is estimated to grow from USD 505.98 billion in 2023 to approximately USD 10,478.93 billion by 2033, According to Precedence Research. The asset management market is driven by increasing IT infrastructure, increasing AI usage, and advanced technology.

The asset management market encompasses a wide range of services, including the planning, acquisition, oversight, and disposition of various types of assets with the goal of maximizing returns and minimizing risks. Asset management is the process of purchasing, selling, and managing investments with certain risk tolerances to build wealth over time. Asset managers, sometimes known as portfolio managers or financial counselors, serve a variety of clients, including governments, corporations, and institutional investors. Their goal is to increase the value of an investment portfolio while retaining an acceptable degree of risk.

Asset managers have a fiduciary duty to act in their client’s best interests and make decisions on their behalf in good faith. They choose investments, including equities, bonds, real estate, commodities, alternative investments, and mutual funds. Asset management might entail conducting extensive studies utilizing both macro and microanalytical methods to meet the client’s financial objectives.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2799

Asset Management Market Key Insights

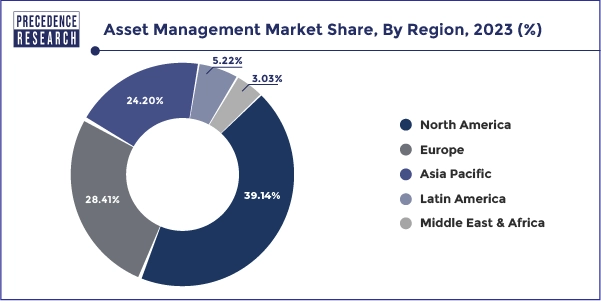

- North America dominated the asset management market with the largest revenue share of 39.14 % in 2023

- By component, the solution segment generated more than 57% of revenue share in 2023.

- By asset type, the digital assets segment captured the largest revenue share of 25.8% in 2023.

- By application, the aviation segment held more than 82% of the revenue share in 2023.

U.S. Asset Management Market Size and Forecast

The U.S. asset management market size was valued at USD 138.89 billion in 2023 and is expected to surpass around USD 3,034.44 billion by 2033 with a significate CAGR of 36.1% from 2024 to 2033.

North America dominated the asset management market in 2023. The asset management sector in North America comprises a wide range of businesses, investors, and regulatory frameworks, and it plays a major role in the national economy. In this industry, the US is the leader with several well-known asset management companies. The landscape is changing because of new laws, shifting investor preferences, and technological improvements.

Exchange-traded funds (ETFs), a kind of passive investment, are becoming more and more popular and are posing a threat to traditional active management. For businesses to stay competitive in a digitalized market, technological advancements in artificial intelligence, machine learning, and big data analytics are revolutionizing investment processes and enhancing risk management, portfolio creation, and client experiences.

Asia Pacific is observed to grow at a fastest rate during the forecast period. Many countries in the APAC region, particularly China and India, are experiencing rapid economic growth. This economic expansion is leading to an increase in personal and corporate wealth, which in turn boosts the demand for asset management services.

Countries like China are opening up their financial markets to foreign investors, which is drawing significant interest from global asset managers. There is a growing emphasis on ESG criteria in investment decisions in the APAC region. Investors are increasingly looking for sustainable and socially responsible investment opportunities, which is shaping the asset management landscape.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Asset Management Market Coverage

| Report Attribute | Key Statistics |

| Market Size by 2033 | USD 10,478.93 Billion |

| Market Size in 2024 | USD 685.09 Billion |

| Market Size in 2023 | USD 505.98 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 35.4% |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Year | 2024-2033 |

| Segments Covered | By Component, By Asset Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Asset Management Market Segments Outlook

Component Outlook

The solution segment dominated the asset management market in 2023. Asset tracking, which gives real-time information on the location, state, and upkeep of assets, is an essential component of asset management systems.

Software that is easy to use is necessary for effective operations. Software should be able to be customized and should work with current devices and technologies. Growth requires scalability, which should be simple to update. The answer ought to be solution-focused, offering features and assistance when required.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/2799

Asset Outlook

The digital assets segment dominated the asset management market in 2023. Organizations may benefit greatly from digital asset management (DAM) in many ways, such as better collaboration, more time and money savings, efficient rights management, effective analytics, and targeted marketing.

A centralized repository for digital assets is provided by DAM, fostering collaboration, guaranteeing legal compliance, and enabling rapid and effective searches. In addition, it provides sophisticated automation tools that guarantee legal rights and save licensing costs. Businesses may also use DAM to use consumer data for targeted marketing activities.

Application Outlook

The aviation segment dominated the asset management market in 2023. Cost savings, higher productivity, improved asset life, customer happiness, tracking assets and inventories, thorough reporting, efficient auditing, and adherence to legal requirements are just a few advantages of aviation asset management. In airport infrastructure, maintenance and repair operations (MRO) are essential since they save costs and avert equipment failures. Software for asset management facilitates the creation of adaptable operating plans and optimal results, and asset life monitoring informs managers when maintenance is necessary.

Better performance, scheduling, and on-time departures all contribute to a better customer experience. Maintaining inventory and asset records also aids in preventing theft and misplacement. Finally, asset availability and compliance with legal requirements are ensured by efficient audits made possible by asset management software. All things considered, asset management software is critical to the aviation industry's ability to maximize operations and reduce maintenance costs.

Browse More Insights:

-

Blockchain IoT Market Size and Forecast: The global blockchain IoT market is expected to drive growth at a CAGR of 54% during the estimated period and to reach USD 20,938.59 million by 2032 from USD 280 million in 2022.

-

Location Intelligence Market Size and Forecast: The global location intelligence market size is projected to reach around USD 54.8 billion by 2032 from USD 18.3 billion in 2022 and is poised to grow at a CAGR of 11.59% during the forecast period 2023 to 2032.

-

Healthcare Asset Management Market Size and Forecast: The global healthcare asset management market size is estimated to reach USD 189.8 billion by 2032 valued at USD 21.02 billion in 2023 and poised to grow at a CAGR of 27.7% during the forecast period 2023 to 2032.

-

Enterprise Asset Management Market Size and Forecast: The global enterprise asset management market size was valued at USD 4.63 billion in 2023 and is expected to hit around USD 12.42 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 10.35% during the forecast period 2024 to 2033.

-

Smart Manufacturing Market Size and Forecast: The global smart manufacturing market is projected to grow at an impressive CAGR of 16% during the forecast period 2023 to 2032. The global smart manufacturing market size was valued at USD 226.3 Billion in 2022 and is expected to reach USD 985.5 Billion by 2032.

-

AI in Asset Management Market Size and Forecast: The global AI in asset management market size was USD 3.71 billion in 2023, calculated at USD 4.62 billion in 2024 and is expected to reach around USD 33.25 billion by 2033. The market is expanding at a solid CAGR of 24.52% over the forecast period 2024 to 2033.

-

Aviation Asset Management Market Size and Forecast: The global aviation asset management market size was estimated at USD 183.38 billion in 2022, and it is expected to be worth around USD 327.48 billion by 2032, expanding at a CAGR of 5.97% during the forecast period 2023 to 2032.

-

Infrastructure Asset Management Market Size and Forecast: The global infrastructure asset management market size reached USD 37.65 billion in 2023 and is expected to hit around USD 86.31 billion by 2033, poised to grow at a CAGR of 8.70% from 2024 to 2033.

-

Data Center Infrastructure Management (DCIM) Market Size and Forecast: The global data center infrastructure management (DCIM) market size surpassed USD 2.77 billion in 2023 and is expected to hit around USD 11.65 billion by 2033, poised to grow at a CAGR of 15.50% from 2024 to 2033.

- Corporate Learning Management System (LMS) Market Size and Forecast: The global corporate learning management system (LMS) market was estimated at USD 9.98 billion in 2023 and is expected to hit around USD 63.12 billion by 2033, poised to grow at a CAGR of 20.24% during the forecast period from 2024 to 2033.

Asset Management Market Dynamics

Drivers

Technological advances

Machine learning, Artificial intelligence, and big data analytics are some of the technical innovations that are rapidly changing the asset management market. These technologies are enhancing operational effectiveness, enhancing investment choices, and offering customized customer experiences.

This shift improves risk management, portfolio performance, scalability, and agility in reaction to market conditions and investor preferences, allowing asset managers to be competitive in a digitalized environment.

Increase in business reliability

Regular asset assessment and review can assist in preventing operational breakdowns, unexpected repairs, and wasteful purchases. It guarantees the timely delivery of services and products to clients.

Risk assessment is critical in asset management because it ensures that firms are accountable to consumers, workers, vendors, and other stakeholders. It helps to prioritize assets based on their duties and eliminates all forms of risks, making the firm more efficient and dependable.

Restraint

Strict Regulations

Asset management includes adhering to standards governing safety, environmental protection, and asset disposal. Maintenance management software can help asset managers track rules, generate compliance reports, set digital signatures for approval, send compliance warnings, and keep compliance audit trails. Regulation tracking enables asset managers to stay updated about legislation and take the required procedures to comply.

Compliance reporting provides evidence that the organization is meeting regulations and requirements. Digital signatures are used to approve work order closing permissions and other regulatory compliance papers. Compliance alerts notify asset managers when regulations or standards are approaching or have been broken, allowing them to take appropriate action. Compliance audit trials provide precise evidence of compliance efforts.

Opportunity

AI in asset management

The AI revolution provides an opportunity for the asset management market to invest in and integrate AI into their operations, hence improving their three Ps approach. AI may boost productivity by increasing decision-making and operational efficiencies, creating personalized portfolios, and customizing client experiences.

It can also improve deal teams’ efficiency in private marketplaces, resulting in increased value creation. Asset managers should see these technological advancements as transformative instruments for their organizations.

Asset Management Market Top Companies

- IBM Corporation

- SAP SE

- Oracle Corporation

- Infor Inc.

- ABB Ltd.

- CGI Group Inc.

- Hitachi Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Cisco Systems Inc.

- Johnson Controls International plc

- Rockwell Automation Inc.

- Wipro Limited

- Honeywell International Inc.

Recent Developments:

-

In June 2024, a strategic alliance was forged by Tikehau Capital and Nikko Asset Management to expand their worldwide investing footprint and capabilities. A joint venture, a distribution agreement, and Nikko Asset Management's equity investment in Tikehau Capital are all part of the relationship. The collaboration, which was declared in December 2023, is now official.

-

In June 2024, to improve climate-related disclosures for Swiss pension funds, sustainability software startup Clarity AI has teamed up with asset management firm Syz Asset Management, based in Switzerland. Through the use of cutting-edge technology from Clarity AI, the alliance intends to assist the portfolio managers at Syz Asset Management in offering ASIP analytics to their customers.

-

In June 2024, AI-powered technologies to improve asset lifecycle management, save costs, increase dependability, and support sustainability objectives are included in IBM's Maximo Application Suite 9.0. Work order intelligence, enhanced field service management, and optimized dependability techniques are some of the key elements that improve asset management effectiveness and lower greenhouse gas emissions.

Market Segmentation

By Component

- Solution

- Real-Time Location System (RTLS)

- Barcode

- Mobile Computer

- Labels

- Global Positioning System (GPS)

- Others

- Service

- Strategic Asset Management

- Operational Asset Management

- Tactical Asset Management

By Asset Type

- Digital Assets

- Returnable Transport Assets

- In-transit Assets

- Manufacturing Assets

- Personnel/ Staff

By Application

- Infrastructure Asset Management

- Transportation

- Energy Infrastructure

- Water & Waste Infrastructure

- Critical Infrastructure

- Others

- Enterprise Asset Management

- Healthcare Asset Management

- Aviation Asset Management

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2799

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: