SMACOM's unique FS Forecast Score - Coronavirus spread changes industry averages

Nikkei FTRI makes projections concerning future financial statements and represents the information as the FS Forecast Score, offering investment insight.

TOKYO, JAPAN, June 8, 2022 /EINPresswire.com/ -- Japanese companies continue to be affected by the prolonged coronavirus pandemic. Sluggish personal consumption has led to an increasingly troubled profit environment in more and more areas, and this has greatly contributed to the deterioration of business confidence in Japan. Here, we examine the financial conditions faced by Japanese companies given the coronavirus crisis using the FS Forecast Score. This measurement is available through SMACOM, a platform that provides corporate analytical information.The FS Forecast Score was developed by Nikkei FTRI, which provides projections concerning future financial statements and represents the information in a way that is useful for making investment decisions. This score is employed in creating various financial ratios with data from AERIS, which are in turn used by many institutions as forecasting tools. The FS Forecast Score is thus highly beneficial for equity management.

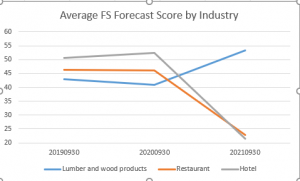

The following graph shows the FS Forecast Score by industry, indicating average values at the end of September 2019, September 2020, and September 2021(CHART1) .In general, a score at any given point in time is calculated based on the expected financial ratio one year in the future. Thus, the higher the score, the more likely it is that the financial situation will improve within the coming year, indicating a more positive attitude toward equity investment.

The hotel and restaurant industries, which were directly affected by the coronavirus pandemic, were still maintaining their pre-corona score levels at the end of September 2020. However, it can be seen that after a year had gone by, in September 2021, their scores had dropped quite a bit. Their profit environments did not improve in the following period, and the continued worsening of their financial positions (i.e., the waning of their attractiveness as investment targets) was apparent one year later. The FS Forecast Score for each of these industries fell steeply in the first half of the year. It is clear that the fundamentals (or basic economic conditions) of the hotel and restaurant industries had weakened significantly.

On the other hand, the opposite trend was seen in the lumber and wood products industry. This sector includes companies that provide building materials and furniture. Although the industry score declined slightly at the end of September 2020, it turned upward a year later. This is considered to be a case in which the impact of the coronavirus was positive, and it could be an important indicator for stock selection when considering equity investments.

When long (buy) positions are taken for stocks each having an FS Forecast Score of 90 or above and they are held for 240 days, their overall performance (represented by the blue line) is significantly higher than the market average (TOPIX = Tokyo Stock Price Index; orange line). This demonstrates the effectiveness of the FS Forecast Score in the stock selection process. (CHART2)

Given all of the above, using FS Forecast Score as an aid for improved selection of stocks and construction of an optimal management strategy for such equities may be an effective way to ensure a certain level of investment performance. This could be true even in times marked by daunting fundamentals, such as during the ongoing coronavirus pandemic.

Nikkei FTRI is currently offering a free trial of SMACOM. If you are interested, please contact us by clicking below:

https://www.ftri.co.jp/eng/index.html#company

Disclaimer (PDF file):

https://www.ftri.co.jp/eng/pdf/SMACOM_Disclaimer-EN.pdf

Public Relations Office

Nikkei Inc.

pr@nex.nikkei.co.jp

Visit us on social media:

Facebook

Twitter

LinkedIn

Other