Will Cash Survive ... For Now, Our Soul Searching Thoughts @ Payments2.0

The latest trend that is being noticed when people discuss the future of payments they tend to predict the end of cash. Our Soul Searching Thoughts Shared ...

It is not new now in many parts of the world, people are becoming more familiar with non-cash payments such as paying with points accumulated through credit card spending and airline travel.”

BANGALORE, KARNATAKA, INDIA, September 19, 2020 /EINPresswire.com/ -- The latest trend that is being noticed when people discuss the future of payments they tend to predict the end of cash or even its death. Being in the industry and studying trends, Our view at Payments2.0 is different. Not only do we think cash will be around for sometime, we also believe and see the transition to digital payments as having the potential to do no less than rebalance global economic power.— Rohan F. Britto, Director International Development at Payments2.0

While we believe cash will stay for sometime, the coming decade will see an explosive growth in digital payments, the Covid19 pandemic has only fueled it faster than we expected leading probably slowly to the extinction of the plastic card. Over the next five years, we expect mobile payments to comprise two-fifths of in-store purchases in the US alone, quadruple the current level. Similar growth is expected in other developed countries, however, different countries will see different levels of shrinkage in cash and plastic cards. In emerging markets, the effect could arrive even sooner. Many customers in these countries are transitioning directly from cash to mobile payments without ever owning a plastic card - Yes this is absolutely true!

Digitization will surely give businesses extra incentive to smoothen the payments transition. For starters, when customers are comfortable with a payment technology, they tend to think less about how much they spend. Furthermore, as the data gleaned from payments becomes increasingly valuable, payment fees will approach zero. Business-to-business transactions will also benefit. Currently, corporates especially if dealing with governments or large conglomerates wait almost 70-120 days for payments after goods or services delivered. The number one reason for this is inefficient internal processes which lead to payment delays, something digitization can fix.

An Observation worth sharing is that Governments, banks, and card providers share at least one common goal, "the elimination of cash". Governments are more concerned with eliminating large notes from circulation because those notes are mostly used for the black market, but banks find moving cash is more expensive and card providers have been finding ways to foster smaller payments with cards through technology innovations, such as contactless cards (cards that can be used without inserting or swiping them in a reader) and mobile payments.

Now at Payments2.0 we have been striving at addressing these pain points we have witnessed ourselves and developed a solution not just using state-of-the-art technology but also practical usage to make it commercially viable for one and all the stakeholders involved including the Customer who is King now.

Our Payments2.0 platform versatile capabilities include

* PAYMENT PROCESSING

Our end to end payments processing solution improves efficiency simplifying operations

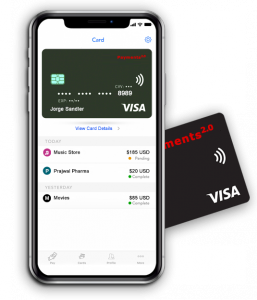

* DIGITAL WALLETS

Digital wallet solutions are about more than convenience, creating an alternate banking ecosystem

* DIGITAL CARDS

Take advantage of Digital payment cards to suit your needs – prepaid cards, multicurrency cards, Stored value cards, FX travel cards

* BLOCK CHAIN

Crypto currency wallets linked with regular multicurrency wallets enabling faster and secure transfers

* MULTICURRENCY PLATFORM

Flexibility to store permissible multi currencies with freedom to convert and load between wallets to complete the transaction.

*REMITTANCES

Enabling faster cross border remittances using digital wallets and block chain technology.

* FIAT TO CRYPTO PAYMENTS

Global users can now pay with Crypto using their regular card linked to their multicurrency wallet.

* BUY CRYPTO WITH CREDIT CARD

Our card processing solution and seamless integration with Crypto exchanges facilitates global users to buy crypto coins using credit cards.

Banks and payment providers need to adapt to industry convergence and need to create new sources of revenue, because fees from facilitating pure payment transactions are likely to be significantly eroded.

To stay relevant, banks and payment providers need to:

* Take a strategic, holistic perspective on payments and consider payment‑proximate activities

* Identify markets, business areas and services where payments are a crucial aspect

* Evaluate and prioritize viable options as to where and how to play

* Define the required business enablers

* Allocate resources and investments to develop solutions that add value

* Keep consistent and well-designed customer experience as a main guideline

* Explore new partnership models, including strategic cross-industry alliances

I will conclude by showing you evidenceof how people are getting comfortable using an independent non-government currency which is definitely a sign that digital is not only being used but widely accepted as the most preferred choice of completing a transaction especially in the pandemic era.

It is not new now in many parts of the world, people are becoming more familiar with non-cash payments such as paying with points accumulated through credit card spending and airline travel. Among US citizens, 45 percent of people are comfortable using an independent, non-government currency. This is evidenced by the widespread use of corporate points programs. The Starbucks Rewards app—one of the leaders in mobile payment apps—recorded about 17 million US memberships in 2019. Thirty percent of payments at Starbucks stores occur with the company’s points program and many more examples i can share quipped Rohan F. Britto, Director International Development at Payments2.0

Rohan Francis Britto

Rijndlpay Technologies Pvt. Ltd

+971 55 635 0635

email us here