Making the Most of Capital Flows in the Middle East and Central Asia

(Aerial view of Tashkent, Uzbekistan / photo: iStock)

October 28, 2019

The latest Regional Economic Outlook analyzes the evolution of capital inflows to the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region and to countries in the Caucasus and Central Asia (CCA), exploring how they can most effectively contribute to economic growth.

As economies in the Middle East and Central Asia become increasingly integrated into global capital markets, a central question has emerged: How can countries reap the benefits of capital inflows while guarding against the risks posed by sudden market shifts? Capital inflows can take several forms, such as foreign direct investment (FDI), portfolio flows, and wholesale funding to banks.

“In an increasingly challenging global environment, it is imperative that MENAP and CCA countries attract and take full advantage of foreign direct investment,” said Jihad Azour, director of the IMF’s Middle East and Central Asia Department. “This will be vital for the region as it seeks to achieve higher and job-rich growth.”

How did capital flows evolve in the last decade?

FDI inflows have slowed globally—a trend that has been even more pronounced in MENAP and CCA countries. In 2008, FDI reached $115 billion in the two regions, but between 2015-18, it declined to an average of $46 billion annually. Meanwhile, portfolio inflows, which are foreign purchases of stocks and bonds, have been on the rise. CCA and MENAP countries accounted for 20 percent of portfolio inflows to all emerging markets between 2016-18, up from merely 5 percent before the 2008 global financial crisis.

The drastic increase in portfolio flows is particularly strong in oil-exporting countries—increasing from $10 billion in 2008 to $40 billion in 2018—which has helped offset the sharp decline in FDI. For oil importers, a surge in other forms of capital flows—including increases in foreign deposits and wholesale funding in the domestic banking system—from $9 billion in 2008 to nearly $23 billion in 2018 have helped fill the void.

These developments come at a time when many countries are facing fiscal challenges. Fortunately, portfolio and bank inflows have helped countries finance fiscal and balance of payment deficits—avoiding a sudden financing crunch—which could cause a harmful drop in consumption and investment. For example, in oil exporters Bahrain and Oman, capital inflows helped governments meet their financing needs as they worked to improve their fiscal positions.

However, IMF research shows that portfolio inflows to the MENAP and the CCA regions are more sensitive to changes in perceived global risk, meaning a heavy reliance comes with its own risk—particularly amid the current, more challenging global economic environment.

How can countries best take advantage of capital flows?

Revitalizing FDI can help boost productivity through the transfer of new technology, contribute to job creation for a fast-growing population, and serve as a stable source of financing for countries. Removing investment restrictions and increasing protections and opportunities for investors are key elements to achieving this goal.

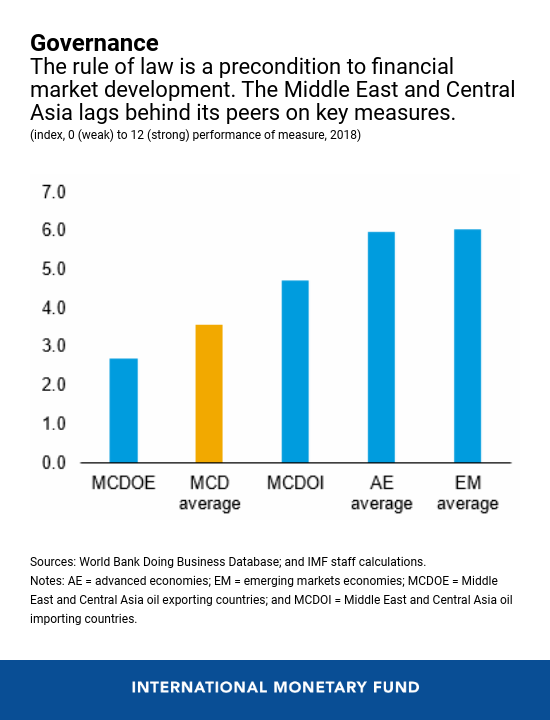

Encouraging signs have been seen in Uzbekistan, which recently granted preferential travel arrangements for foreign investors, as well as in Bahrain and the United Arab Emirates, which now allow for 100 percent foreign ownership in an expanded group of economic sectors. In the long term, increasing potential growth; strengthening governance, including the rule of law; enhancing education quality; and working to achieve macroeconomic stability will help countries across the region attract more FDI.

Countries can also take steps to reduce vulnerabilities. Building foreign reserves and, where feasible, allowing exchange rates to adjust and absorb shocks can help insulate economies from the impact of capital flow volatility. Continued financial market development is also vital to helping countries absorb large capital flow fluctuations and the economic shocks that come with them. Strong regulatory frameworks are essential to this effort. Bahrain, Saudi Arabia, and the United Arab Emirates have all worked to modernize their bankruptcy laws—more reforms like this are needed throughout the Middle East and Central Asia.

By attracting more FDI and taking steps to insulate themselves from the volatility of portfolio inflows, capital flows can play a key role in unleashing the economic potential of countries throughout the region.