Rankings & Market Shares of Top Tier-1 ADAS Suppliers

Learn which suppliers lead the race to higher levels of autonomy by total ADAS revenues, unit sales of sensors-the cameras, radars, Lidar and ultrasonic sensors

LONDON, GREATER LONDON, UK, May 24, 2019 /EINPresswire.com/ -- ADAS Component Revenue from Top-7 Tier-1 Suppliers will almost double by 2020

ADAS content per vehicle, i.e. the fitment of radars, cameras, ultrasonics and other components necessary for driver assistance and higher levels of autonomy, will rise significantly in major car markets driven by changes in safety regulation and rating, the competition to offer higher levels of autonomy and lower cost of sensors.

ADAS Content per Vehicle in 2020 will range from €489 for Level 2, with 17 sensors per car, to €960- 2,100 for Level 3 depending on the usage of lidar or not for redundancy.

Auto2x expects that in 2020, 42 models capable of Level 3 autonomy (Traffic Jam Pilot, Highway Pilot) and 94 models with Level 2 (Traffic Jam Assist, Cruise Assist) –mostly as optional equipment -will be offered in Europe, as the regulatory hurdles gradually clear away.

Since many carmakers don’t manufacture ADAS features or sensors in-house, they rely on suppliers who are the leading manufacturers and distributors of components and features.

Suppliers are well-positioned to monetise the strong demand for ADAS components

Already, Top ADAS Tier-1s such as Bosch, Continental and Aptiv, have recorded billions in ADAS Order Intake while they continue to invest to increase production capacity and shorten time-to-market. To close the technological gap and accelerate time-to-market, partnerships and synergies gain momentum to share costs and knowledge.

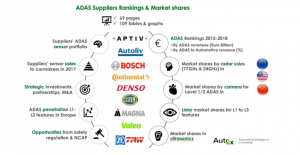

The leading 7 ADAS Suppliers will experience average ADAS revenue growth of CAGR 21.5% between 2017 and 2020 which will lead to changes in the global Ranking-by-ADAS Revenue.

Our report examines the portfolio, strategy and roadmap of leading ADAS Suppliers to deliver:

1. Rankings and Market shares by ADAS Component Revenue in 2015-17 & 2020 (€);

2. Ranking by ADAS-to-Automotive Revenue;

3. 2017 market shares in 77/24GHz radar, camera, Lidar, ultrasonics in major markets;

4. Competitive assessment & outlook for 2020;

5. Market shares of ADAS Suppliers in sales of L3 radar and Lidar in Europe in 2020.

What this report delivers

This report focuses on the leading manufacturers of the cameras, radars, Lidar and ultrasonic sensors used for ADAS since we have identified them as the ones to benefit more from the uptake of ADAS penetration and the eventual transition towards semi-autonomous and self-driving cars.

Our Tier-1 Supplier Ranking by ADAS revenues (EUR Bn) includes: Autoliv, Aptiv, Bosch, Continental, Denso, Hella, Magna, and Valeo. However, the companies examined include:

- AdasWorks

- Harman International Industries

- Renesas Electronics Corporation

- Aisin Seiki Co

- Hella KGaA Hueck & Co

- Takata Corporation

- Ambarella Inc.

- Hitachi Automotive Systems

- Texas Instruments

- Autoliv Inc.

- Hyundai Mobis

- TRW Automotive

- Bosch Group

- Infineon Technologies AG

- Valeo SA

- Continental AG

- Magna International Inc.

- Vector Informatik

- Delphi Automotive Systems LLC

- Mobileye N.V

- Velodyne LiDAR, Inc.

- Denso Corporation

- NVIDIA

- Visteon

- Freescale Semiconductors

- OmniVision Technologies

- Wabco

- Gentex Corporation

- Panasonic Corporation

- ZF Group (incl. ZF TRW)

- Green Hills Software

- QNX

Table of contents

1. Executive summary

1.1. ADAS Suppliers’ ranking by ADAS revenues: 2016 vs 2017 vs 2020

1.2. ADAS Suppliers’ ranking in Europe in 2017: Leaders by key sensors

1.3. ADAS Suppliers’ ranking in radar and Lidar: Europe 2017 vs 2020

1.4. Snapshot of the ADAS market revenues in 2020

2. Safetyregulation&competitioncreateopportunitiesforADASSuppliers

2.1. ADAS penetration is rising in key car markets enhancing safety & convenience

2.2. Changes in safety requirements push ADAS into standard equipment

2.3. ADAS are not exclusive to the premium car segment any more

2.4. As the auto industry shifts from HW to SW, suppliers tailor their strategy to lead the ADAS market

2.5. Learnwhysuppliersarewell-positionedtomonetiseADASgrowth

2.6. Challenges for ADAS suppliers

3. Rankings&marketsharesofADAScomponentSuppliersin2015-17

3.1. Ranking of suppliers by Automotive Revenue during 2015-17

3.2. Ranking of suppliers by total ADAS revenue between 2015 & 2017

3.2.1. Learn which Suppliers have recorded the stronger ADAS revenue growth during 2015-17

3.2.2. Suppliers’ Shares in combined Top-11 ADAS Revenue in 2016-17

3.3. ADAS-to-Automotive Revenue in 2015-17 for leading Suppliers

3.4. Ranking of Leading Tier-1s by ADAS Sensor in Europe in 2017

3.4.1. ADAS sensor technology overview in 2017 by leading supplier

3.4.2. Forward-looking radar at 77GHz for ACC & TJA features

3.4.3. Corner radar at 24GHz for Blind Spot Monitoring

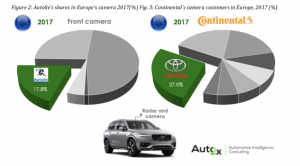

3.4.4. Front-facing camera for AEB, LDW and LKA features

3.4.5. Infrared camera for Night Vision systems

3.4.6. Driver monitoring camera

3.4.7. Lidar for Collision Avoidance redundancy

3.4.8. Ultrasonics

3.5. RankingofLeadingTier-1sbyradarandcamerainChinain2017

3.5.1. Forward-looking Radar shares in China in 2017

3.5.2. Front-facingCamerasharesbyleadingTier-1sinChina2017

3.6. Overview of the ADAS component supplier ecosystem: Tier-1s, 2s and their portfolio

4. LeadingADASsuppliers:analysis,portfolio&keyfigures

4.1. Veoneer (ex Electronics segment of Autoliv Inc.)

4.1.1. Veoneer’s key ADAS figures: revenues and sales of ADAS sensors

4.1.2. Veoneer’sADASportfolio:components and features

4.1.3. Veoneer’scompetitivepositioninEurope

4.1.4. Veoneer’sstrategyandoutlookinADASby2020

4.2. Bosch

4.2.1. Bosch’skeyfiguresonrevenues,salesandproductionofADASsensors

4.2.2. Bosch’s competitive position in ADAS: components and customers

4.2.3. Bosch’s outlook in ADAS for 2017-2020

4.3. Continental

4.3.1. Continental’skeyADASfigures: revenues,sensor sales and production 4.3.2. Continental’s ADAS portfolio: components and features

4.3.3. Continental’s competitive position in ADAS

4.3.4. Continental’s outlook in ADAS by 2020

4.4. Aptiv (ex-Delphi Automotive)

4.4.1. Aptiv’sADASrevenues

4.4.2. Aptiv’s competitive position in ADAS

4.4.3. Aptiv’s outlook in ADAS by 2020

4.5. Denso

4.5.1. Denso’s key ADAS figures

4.5.2. Denso’s competitive position in ADAS

4.5.3. Denso’s outlook in ADAS by 2020

4.6. Hella

4.6.1. Hella’s key ADAS figures and sensors

4.6.2. Hella’s competitive position and outlook in ADAS for 2016-2020

4.7. Valeo

4.7.1. Valeo’s key figures on revenues and sales of ADAS sensors

4.7.2. Valeo’s competitive position and outlook in the ADAS market

5. ADASSuppliers’Rankingin2020

5.1. Forecast of ADAS suppliers’ revenues in 2020

5.2. ADAS-to-AutomotiveRevenueForecastformajorSuppliersin2020

Mariola Skoczynska

Auto2x LTD

email us here

+44 20 3286 4562