Albania: Staff Concluding Statement of the Second Post-Program Monitoring Mission

May 6, 2019

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF's Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

Albania’s medium-term economic outlook is broadly favorable, even though growth is expected to moderate in 2019. Maintaining the growth momentum over the medium term requires reforms to improve the business climate and reduce vulnerabilities. Key risks stem from high public debt, weaknesses in public finances and bottlenecks to financial intermediation. Policy priorities include further fiscal consolidation through well-designed tax policies, better public investment management, and prudent actions to support credit for private sector investment.

An International Monetary Fund (IMF) mission, led by Mr. Jan Kees Martijn, visited Tirana during April 25-May 6, 2019, for the second Post-Program Monitoring (PPM) discussions. PPM is a regular surveillance tool for countries with IMF credit outstanding above 200 percent of quota. PPM missions focus on vulnerabilities and risks to the repayment capacity to the IMF. At the end of the visit, the mission issued the following statement:

Risks to Albania’s capacity to repay seem limited. Although gross financing needs are fairly high due to the relatively short maturity of public debt, debt service, including to the IMF, is expected to remain well within Albania’s capacity to repay. IMF credit outstanding stood at 2.8 percent of GDP at end-2018. Albania’s strong payment record and macroeconomic stability also suggests that repayment risks are contained.

The economic outlook is broadly favorable. Growth is expected to moderate in 2019 but remain close to 4 percent over the medium-term. This year, growth is projected to slow to 3.5 percent, owing to the base effect of record electricity production in 2018 and the slowdown in partner countries. In the medium-term, activity is expected to be driven by a pickup in EU growth, increasing labor market participation, a gradual strengthening of exports including tourism, and the investments needed to close Albania’s large infrastructure gap. However, sustained development also hinges on improvements in economic governance, including in the rule of law and the fight against corruption. As inflation remains well below its 3 percent target, the monetary policy stance should continue to be very accommodative. Inflation is expected to converge slowly towards its target, as the output gap narrows and inflation in the euro area recovers.

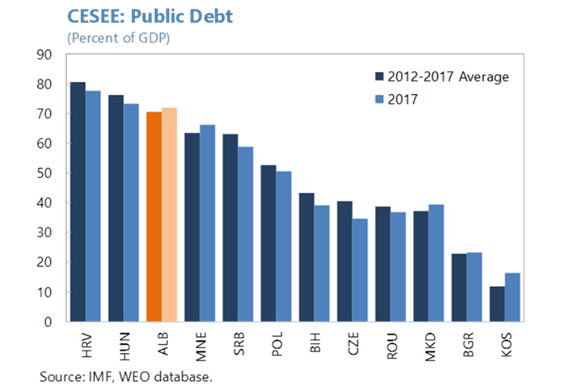

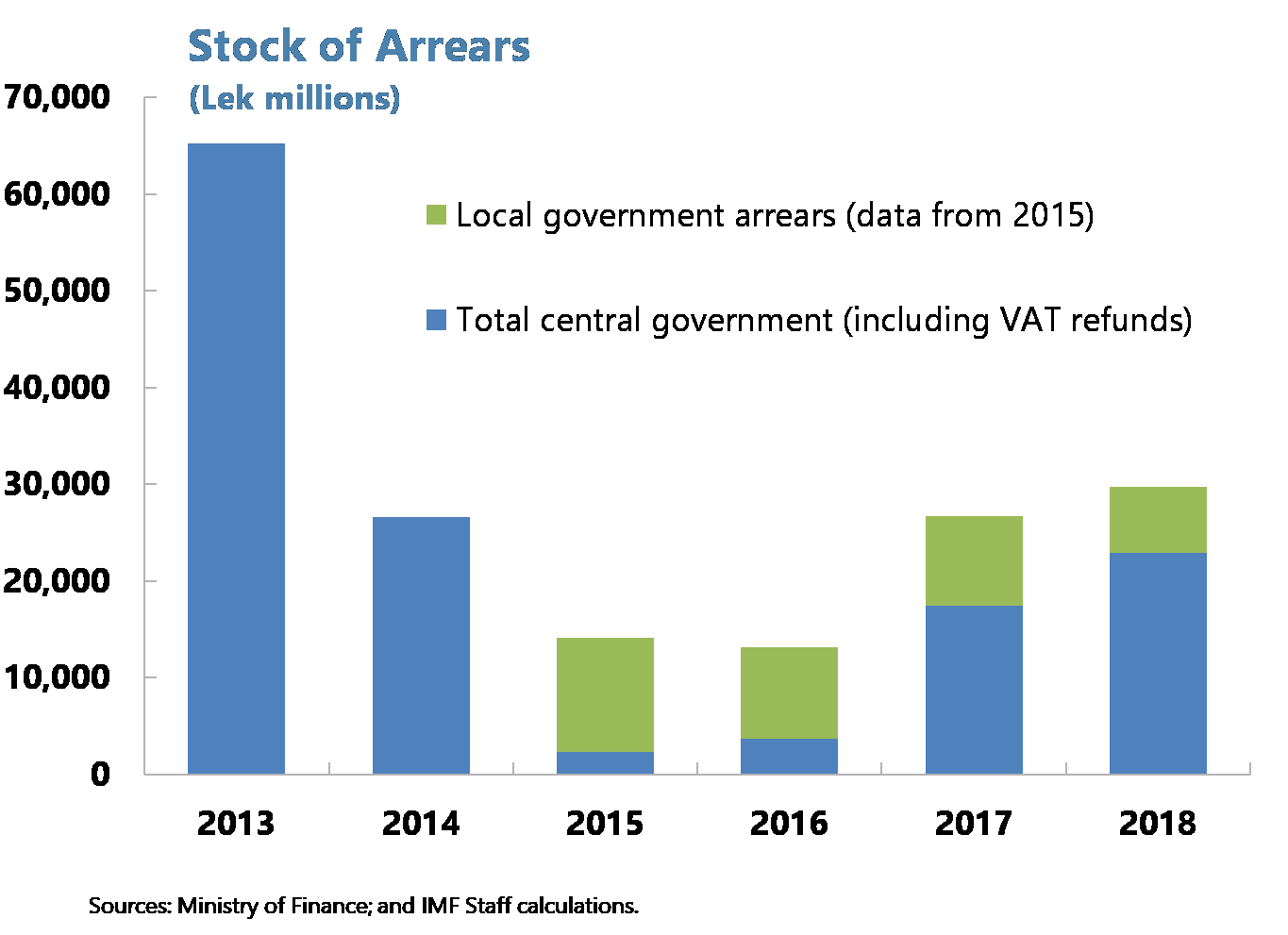

However, there are important downside risks. Albania is significantly exposed to the increasing risks to growth in the EU, notably in its main trading partners. On the domestic front the vulnerabilities are mainly in the public sector. While the fiscal deficit declined in 2018, it is projected to widen to 2.5 percent of GDP in 2019 (including guarantees for new loans to the energy sector of 0.4 percent of GDP). This widening is driven in part by the planned repayment of government arrears which, by itself, is welcome. However, the deficit is also augmented by recent tax measures that erode the already narrow tax base, and introduce preferential treatment of additional sectors, including through reduced VAT and corporate tax rates. Moreover, there are risks of further revenue shortfalls, and expected losses in the energy sector due to lower hydropower production. Despite a decline in recent years, public debt continues to be high at 69.9 percent of GDP (including arrears) at end-2018, and it is projected to decline to 66.3 percent of GDP by the end of this year. At the current level of public debt and the deficit, fiscal policy has little room for absorbing or offsetting adverse shocks. Furthermore, there are fiscal risks from the increasing contingent liabilities, such as those related to public-private partnerships (PPPs).

Building on recent reforms to strengthen risk management and tax administration we recommend containing fiscal risks and creating fiscal buffers that require further fiscal consolidation via sustainable revenue efforts and stronger budgetary institutions. Specifically,

- We urge the authorities to use the favorable economic environment to improve the fiscal position by strengthening the revenue base. Specifically, a front-loaded fiscal adjustment to bring the primary surplus to 1.5 percent of GDP by 2021 should help build fiscal buffers, and ensure faster convergence of debt towards the 45 percent objective stipulated by the organic budget law. This adjustment should be achieved through higher revenues because Albania’s large infrastructure and human development needs argue against expenditure cuts. We recommend strengthening the tax system by reversing measures that fragment and weaken the tax base and by levelling the playing field for businesses. In this context, we welcome the authorities’ intention to develop a medium-term revenue strategy covering both tax policy and administration. This approach should help to build consensus on revenue goals and on a comprehensive package of tax measures for achieving them.

- Urgent action is needed to curtail the persistent public sector arrears. These arrears undermine the business climate and trust in the government. We urge the authorities to ensure the full and timely payment of all validated new VAT refund requests from now on, disconnecting them from corresponding revenue flows. And we welcome the authorities’ plans to repay the outstanding stock of VAT refund arrears as soon as feasible (and for the most part within 2019). It is also important to take swift measures to strengthen commitment controls for investment projects to put an end to government payment arrears, in particular by the road fund.

- Debt management should be improved including by resuming the issuance of short-term (three-months and six months) T-bills. This would be in line with the debt issuance strategy prepared in collaboration with the World Bank. While the authorities have made valuable progress in lengthening the maturity of public debt, this should not halt the issuance of short-term instruments. These instruments are necessary for cost-efficient cashflow management by the treasury as well as commercial banks, for the development of secondary and hedging markets—which utilize the pricing at different segments of the yield curve—and for facilitating BOA liquidity management. Furthermore, while the increased reliance on Eurobond issuances may seem beneficial in favorable times, building a robust and liquid domestic debt market should be a priority as it helps mobilize domestic savings and reduces currency and rollover risks. In this context, it is critical to strengthen the MOFE’s debt management capacity and to ensure good coordination with the BOA.

- We urge the authorities to make use of the recent amendments to the PPP law to limit the risks from PPP-related contingent liabilities and to ensure more consistent public investment management. This is important to protect the public finances and to help ensure value for money. We welcome the amendments that aim to improve risk management of PPPs. As the MOFE embarks on its new role as gatekeeper for PPPs, it will be essential to make sure it has the capacity to assess the risks and costs of these projects, particularly in the pre-feasibility stage. In this context, the Ministry should have access to all contractual information from line-ministries (including for existing projects). Moreover, reversing the fragmentation of decision making in public investment management would greatly enhance cost-effectiveness. We also continue urging the authorities to abolish the use of unsolicited proposals for all PPPs.

- We strongly advise the authorities to revisit recent proposals for establishing the Albania Investment Corporation (AIC), to help avoid risks to the budget and to the integrity of the public investment management framework. The draft law would allow the government to direct individual investment decisions, which could make the AIC an off-budget spending tool that risks eroding fiscal discipline and circumventing public investment management processes. Instead, the framework should ensure that the AIC will operate on a commercial basis and at arm’s length of government. The law should affirm the independence of the AIC in operational decisions and in selecting individual investment projects. The AIC should also be subject to the Public Procurement Law.

- Containing fiscal risks requires improving the performance of the energy sector, which is financially weak and struggling with endemic arrears. The dependence of the sector on rainfall exacerbates its financial vulnerability and creates risks for the government budget (including this year). We encourage authorities to implement the restructuring plan for the sector prepared with World Bank advice to put the sector on a sustainable financial footing.

Further measures are also in order to contain the risks from the financial sector

The banking sector is finishing a consolidation process and is well-capitalized and liquid. We welcome the ongoing measures by the BOA to strengthen the regulatory and supervisory framework and implement Basel standards amidst the changes in bank ownership, and to continue cleaning up bank balance sheets with a reduction in NPLs.

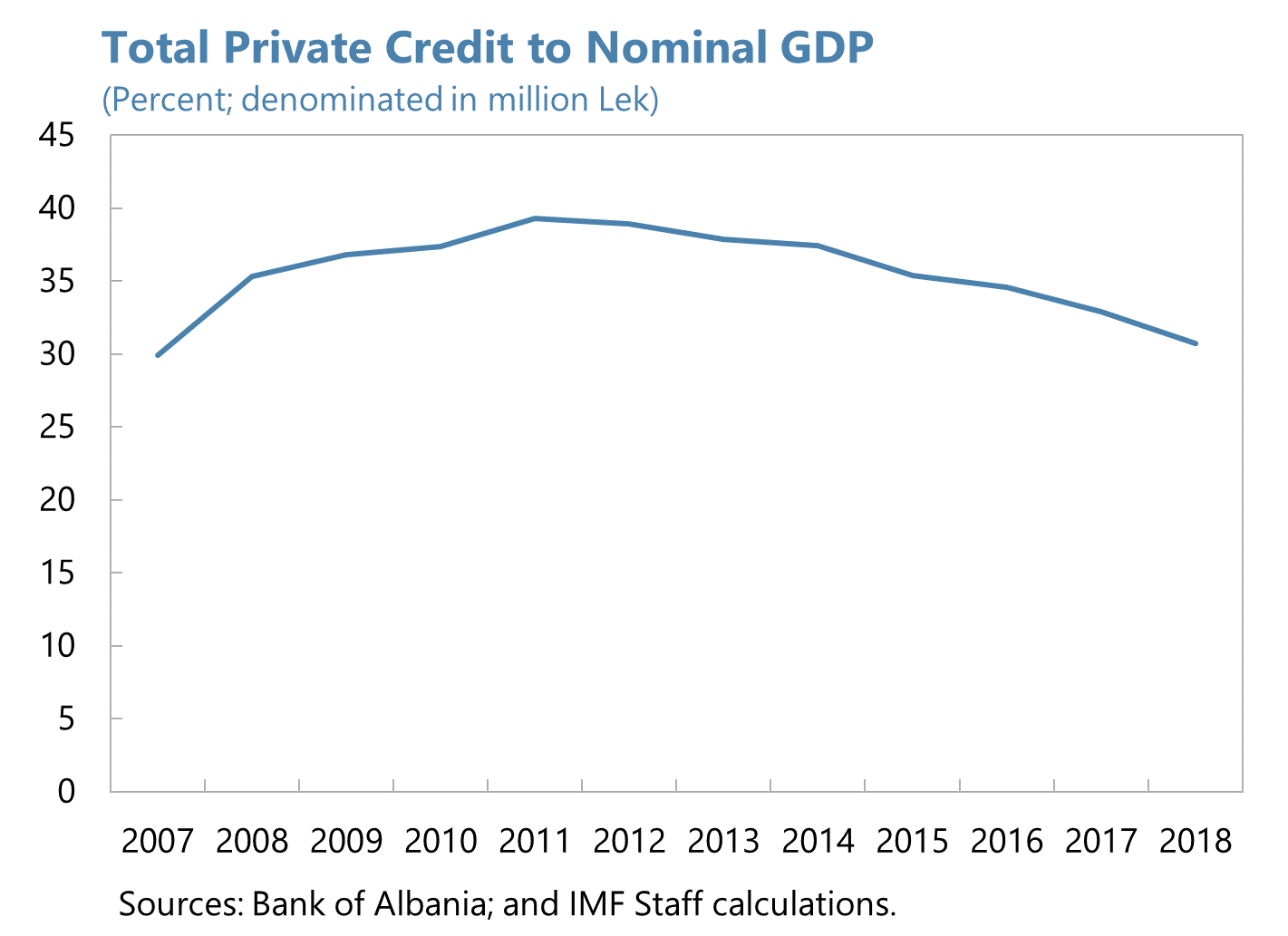

However, structural weaknesses in credit environment undercut the business climate (especially for SMEs) and hinder the transmission of monetary policy. Unlocking credit growth would require an ultimate resolution to the stalemate with bailiffs, full implementation of the insolvency and resolution framework, and government measures to support further de-euroization.

The BOA has been very active in strengthening its supervisory and macroprudential tools. Regarding the latter, the BOA has aligned its regulations more closely with international standards, including on capital buffers and the development of a wide range of macroprudential indicators. The bank has also put in place more intensive inspection and supervision, both on-site and off-site, for banks with new shareholders. However, other banks, including systemically important ones, are inspected on-site only once every two years. We advise the BOA to increase the frequency of inspections to once every year to enhance its ability to identify risks stemming from large exposures and related-party lending in a more timely manner.

We also urge the authorities to continue reforms to address weaknesses in the AML/CFT framework , by implementing the action plans to address the deficiencies identified in the Moneyval evaluation report without delay.

Finally, I want to thank the authorities and all our other counterparts for the excellent collaboration and for their hospitality.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Gediminas Vilkas

Phone: +1 202 623-7100Email: MEDIA@IMF.org