News

Property taxes remain a top priority for Nebraska ag groups

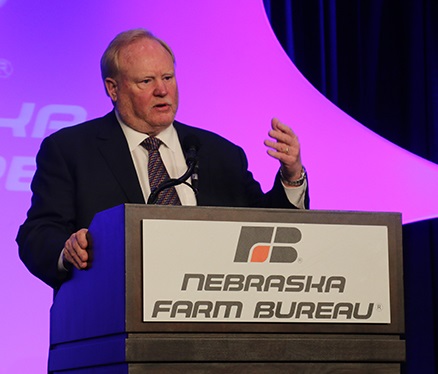

Nebraska Farm Bureau president Steve Nelson, speaking at the group’s annual meeting in Kearney.

Property tax relief remains a top priority for Nebraska ag groups.

Nebraska Cattlemen’s vice president of legislative affairs, Laura Field, says her group has been working with other ag groups in the state on a plan to lower the property tax burden. It includes a lowering of ag land valuations.

“Currently ag land can be valued lower under the constitution,” Field says. “We’re valued at 75 percent now. We would look to lower that to 65 percent and even lower, to try to get those valuations to be driven down.”

Field says changes to the school funding formula to reduce the reliance on property taxes will also be looked at. And she says lawmakers may have to look at bringing in new revenue.

“We all might have to pay a little bit more in sales tax. We might all have to sacrifice a little bit here,” she says. “But to actually see our property taxes go down, which we know are our most significant challenge, we just aren’t ashamed to say that we believe that new revenue probably has to be on the table.”

Speaking at the Nebraska Farm Bureau annual meeting in Kearney, Farm Bureau president Steve Nelson said there has been progress on the property tax issue. But he said making significant changes to state tax policy is like “turning an aircraft carrier”.

“It takes time. It’s large, It’s cumbersome. It doesn’t turn on a dime,” Nelson said. “But we are turning the corner on property taxes. This issue is no longer headed in the wrong direction. It’s headed in the right direction,” Nelson said.

More and more state senators understand the need and importance of fixing the property tax issue, Nelson said. And he added that partnerships with other interests will be needed to secure the votes necessary to advance a property tax relief measure in the legislature in the upcoming legislative session.

AUDIO: Laura Field

AUDIO: Excerpt from Steve Nelson’s annual address

Add Comment