New York Forex Report: Overnight reports that National Security Advisor McMaster may be the next in-line for ousting have been denied by the White House. He is out meeting officials in South Korea and Japan this weekend. Also, Special Council Mueller has subpoenaed the Trump organisation. The USD came under mild pressure. While the Russian’s remain under scrutiny from the US and the UK, it is widely expected that Putin will achieve a landslide victory in elections over the weekend. A relatively quiet day data wise during the London session, with the final readings for Eurozone February CPI inflation confirming the preliminary ‘flash’ estimates, which showed headline inflation fall back to 1.2% from 1.3% in Jan. The ECB forecasts headline inflation to rise to 1.7% by 2020, although ECB President Draghi earlier this week noted a couple of downside risks to the inflation outlook relating to risks of an escalating trade conflict and a stronger euro. A number of US releases are due this afternoon, the main ones being industrial production, which is expected to improve a little, while preliminary readings for the University of Michigan consumer sentiment index will also be released. Strong business and consumer confidence levels, which are at or near cyclical highs, suggest that any downside risk to Q1 GDP may be temporary. The focus now though is on next week’s FOMC and BoE meetings, with UK inflation and labour reports and the EU summit further key highlights.

NORTH AMERICA Initial jobless claims fell to 226k in early March (24 Feb: 231k) which is in line with expectations of a tightening labour market. Overall, the data coincides with readings of non-farm payroll, unemployment rate and wage growth last week, signifying that a stable labour market will continue to drive growth in the US economy. The manufacturing sectors are showing positive signs in the East Coast. The New York Empire Manufacturing jumped to 22.5 in March (Feb: 13.1) beating expectations, indicating that manufacturing conditions have improved substantially in the area. The Philadelphia Fed Business Outlook on the other hand eased to register a reading of 22.3 in March (Feb: 25.8) due to a drop 6- month outlook for capex as well as in both prices paid and received. Generally, both surveys shows that the manufacturing industry is holding up decently.

EUROPE after the UK decided to expel 23 Russian diplomats — the biggest expulsion since the Cold War. On Thursday, news emerged out of Russia that in response to the UK’s move, it would soon expel British diplomats. Also on Thursday, leading figures from France, Germany, the US and the UK went on to issue a joint statement which condemned the chemical attack on a Russian former double agent in England.

EUR/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Technical: 1-3 Day View – Offers ahead of 1.24 contain for now, a close above here opens 1.2630 again, range is contracting a close below 1.23 opens 1.2140.

1-3 Week View – As 1.2130 now acts as support expect a test of 1.2635 as the next upside objective. Weekly close below 1.19 neutralises bullish objectives opening a test of 1.14.

Retail Sentiment: Neutral

Trading Take-away: Neutral

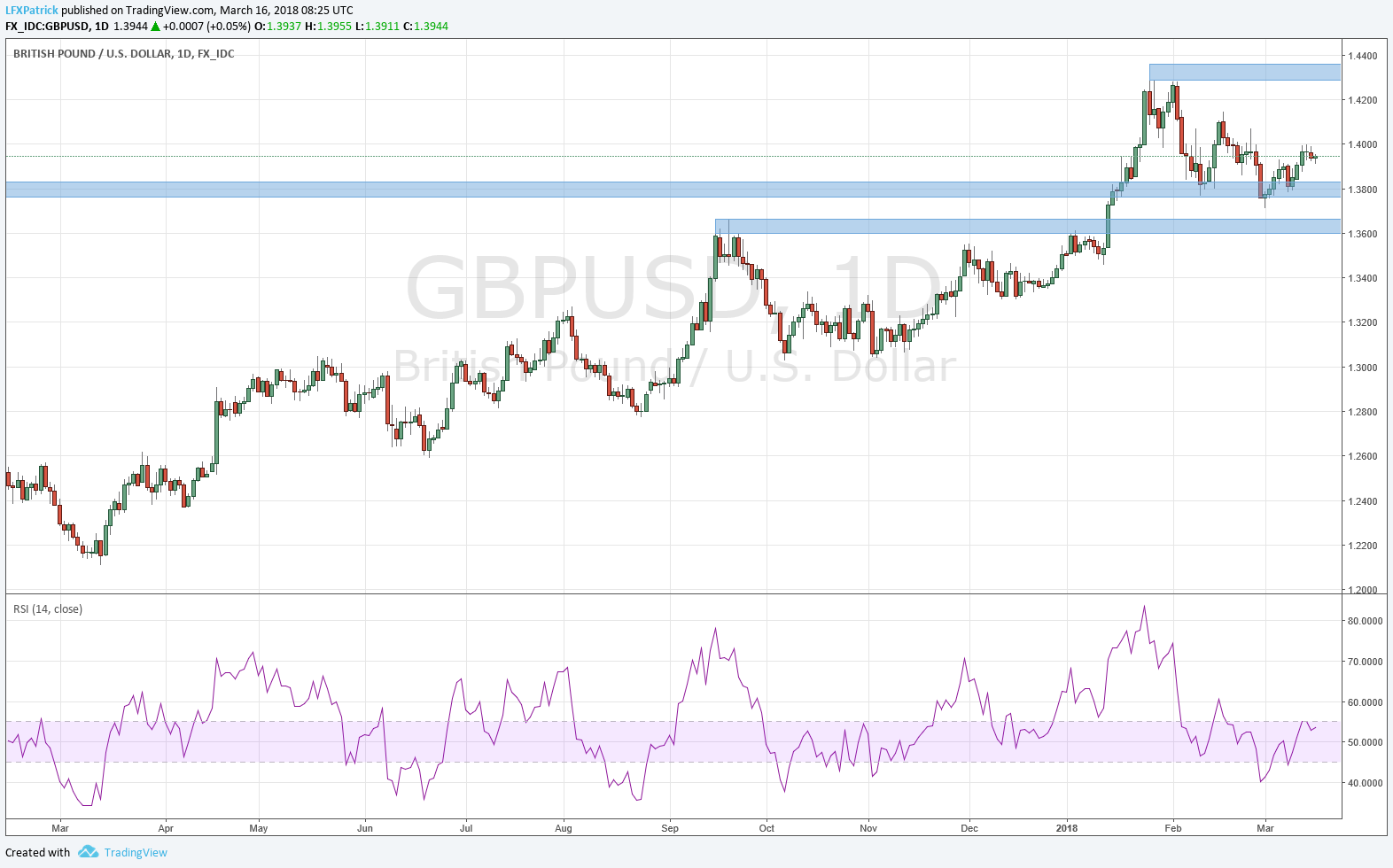

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Technical: 1-3 Day View – The daily close over 1.3925 opens 1.4093, however a close today below 1.3920 suggests a false break and another retest of 1.37 bids

1-3 Week View – As 1.3650 supports 1.45 becomes the next upside objective, only a close back below 1.34 would jeopardise the bullish advance.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: 1-3 Day View – As 108.44 acts as resistance 103.22 is the next downside objective, return to trend confirmed on a daily close below 106.50, near term resistance is sited at 107, with near term support sited at 106.04

1-3 Week View – The close below 108 negates the broader bullish theme and opens the psychological 100 magnet as the next downside objective, only a close above 108.50 stabilises the pair, opening 112.50

Retail Sentiment: Bullish

Trading Take-away: Short

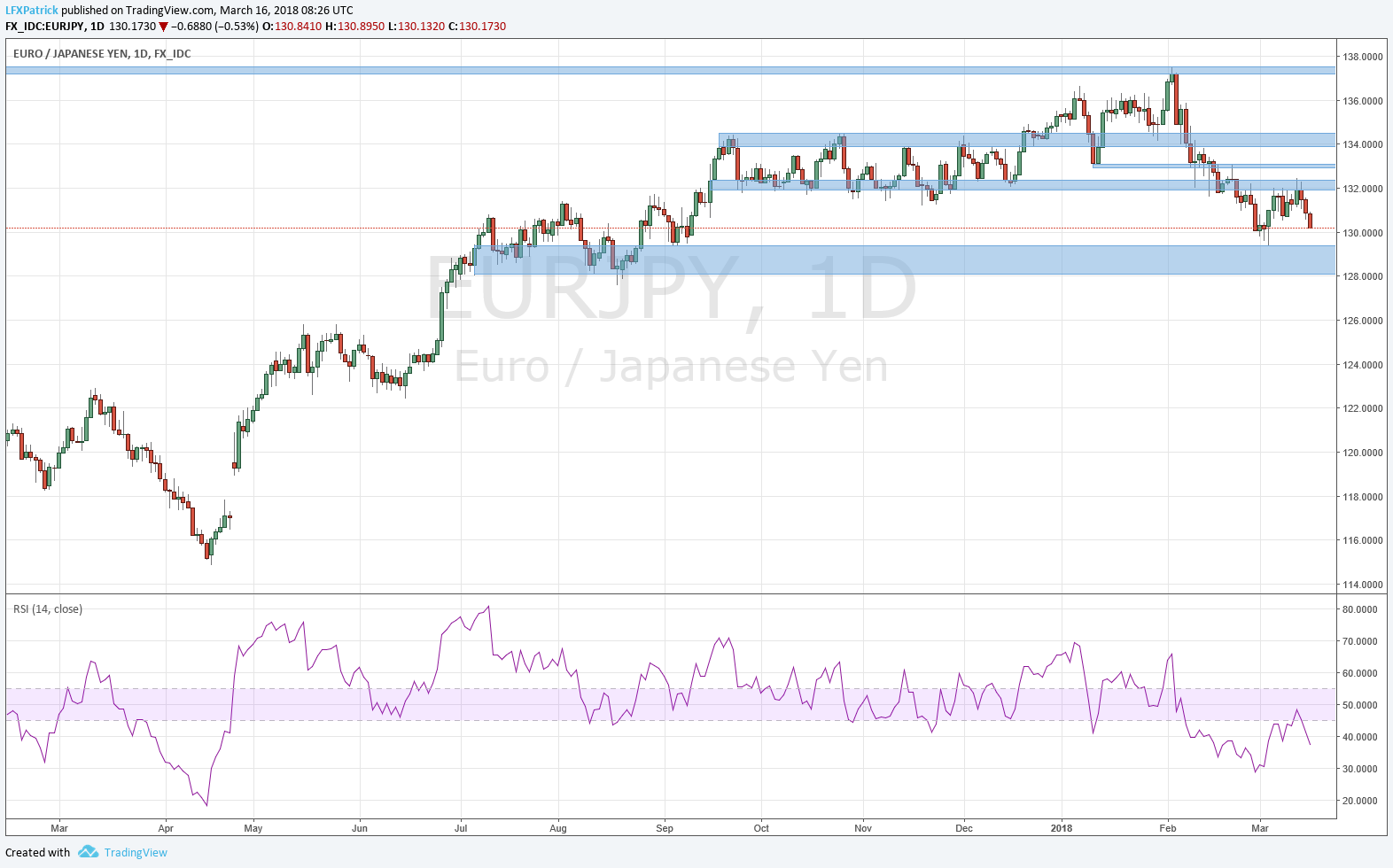

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: 1-3 Day View – Breach of 131 sets a top to target 128.50 as 132 caps corrections. A close over 133 stabilises the pair opening a retest of 135

1-3 Week View – The closing breach of 131 concerns the bullish consolidation bias opening a test of 128.50 while this area supports there is a window to retest and breach cycle highs above 137

Retail Sentiment: Bullish

Trading Take-away: Short