Don’t expect to see the Fed cut interest rates soon.

Ryan Loy, extension economist with the University of Arkansas System Division of Agriculture, said the April 5 jobs report and Wednesday’s Consumer Price Index both showed a still-hot economy, despite the Federal Open Market Committee’s efforts to tame inflation with four increases in the federal target funds interest rate in 2023.

“The CME Group has a FedWatch Tool, so on the Wednesday before this report came out, they had about a 56 percent chance the Fed was going to cut rates at least a quarter of a percent in June,” Loy said, speaking from the Extension Risk Management Conference in Salt Lake City. “As soon as April 5 jobs report came out, it dropped to an 18 percent chance.”

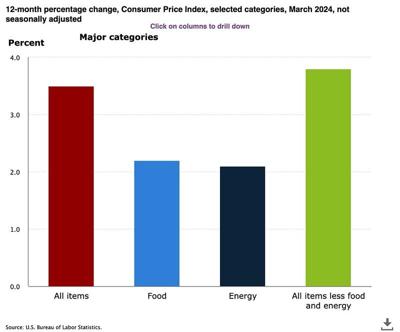

“The problem is that this inflation is really sticky,” Loy said, adding that inflation was declining. In December, it was 3.3 percent, and in January, it was 3.1 percent.

“In February, it came back up to 3.2 percent, but folks really weren’t concerned, because it was just a point increase,” Loy said. “And then we shot back up to 3.5 percent this month.”

In March, the Federal Reserve said in a statement that “the Committee does not expect it will be appropriate to reduce the target range until it has gained confidence that inflation is moving sustainably toward 2 percent … The Committee is strongly committed to returning inflation to its 2 percent objective.”

“That’s their target and they’re just trying to get as close as they can,” Loy said. “The closer we can get to 2 percent; the more likely rate cuts will be. But with this report, the chances of a rate decrease in June is almost zero.

The Fed’s next meeting is set for April 30-May 1.

GAS AND HOUSING

The April 5 jobs report showed the addition of 303,000 jobs. “That’s pretty significant compared to the monthly average over 12 months is 230,000 jobs,” he said. “We kind of blew that out of the water this month.

“Having people employed is obviously good, but it’s a double-edged sword for the economy because it means the economy is strong, and inflation is not going anywhere since a majority of people are still purchasing goods,” Loy said.

However, “gasoline and housing are the big key players here. OPEC extended its cuts into the summer and Ukraine is continuing to bomb Russia’s oil reserves, so prices are being affected on a global scale,” he said. Additional factors “include attacks on shipping in the Suez Canal and drought-slowed shipping through the Panama Canal and the lowered capacity of the strategic reserve.”

The strategic reserve hit a 40-year low after 180 million barrels were released following Russia’s invasion of Ukraine.

According to the March CPI report, housing and food rose 0.4 percent.

Loy said examining the core Consumer Price Index, which doesn’t include highly volatile food, gas or housing prices, “we’re actually on a downward trajectory since April of last year.”

Loy said, “I’ll be very interested in seeing what happens in June and what kinds of decisions will be made.”

Email us at news@magnoliareporter.com

CLICK HERE to find us on Facebook.

CLICK HERE to follow us on X @Magnolia_Report .