Concentration in the S&P 500 Index has reached extreme levels, with performance skewed by a few mega-cap companies. Mannik Dhillon, President of VictoryShares and Solutions for Victory Capital, spoke with ETF Trends about this high concentration and what to pay attention to as far as seeing a new normal, and why this should lead to diversification.

History suggests a high concentration could spell opportunity, particularly to investors who understand the limitations of cap-weighting.

As Dhillon notes, however, “Why concentration is an issue, is because it’s manifesting in multiple places now in people’s portfolios.”

With that notable indication in mind, there is the question of where things will go from here. A concentration on top stocks means finding ways to be more innovative in investing.

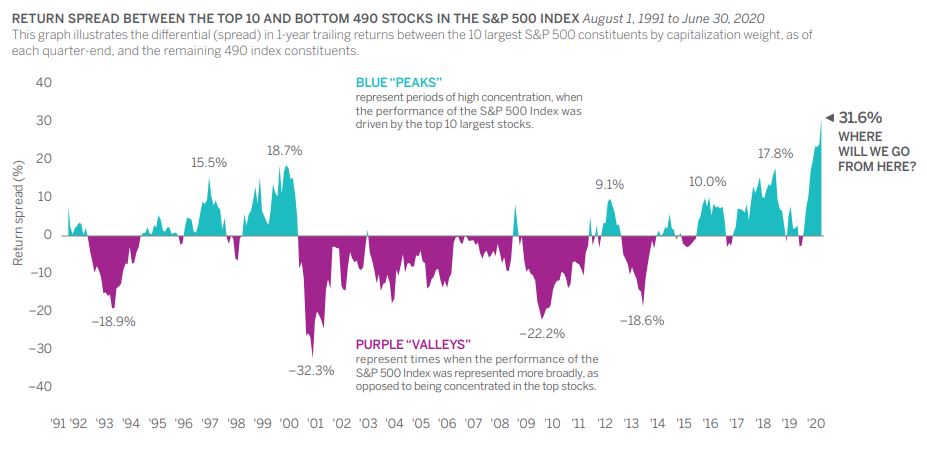

Ultimately, looking back and trying to identify what’s normal, the data shows the contribution of return differential between the largest ten names versus the other 490 on the S&P is at a point of excess. It’s all reflected in a chart published by VictoryShares, seen below.

Past performance is not indicative of future performance. It is not possible to invest directly in an unmanaged index. Index performance is shown for illustrative purposes only.

As illustrated, the return spread shows a current peak that is nearly double what has been seen historically. Although it is essential to keep in mind that past performance does not guarantee future results.

From a weighting/performance perspective, concentration is rivaling what’s been seen in the late 90s. One can factor in how businesses and economic profiles change over time; however, so much concentration is not prudent from a portfolio construction/diversification perspective.

Scott Kefer, Senior Portfolio Strategist at VictoryShares, also notes the growth in defensive sectors such as tech, communications, and healthcare. That added weight has come at the expense of cyclical sectors – financials, industrials, materials, and energy. The magnitude of this jump has left cylicals with roughly 20% of the impact. “It’s an unbelievable phenomenon,” Kefer points out.

Much of this is about creating awareness, so people aren’t caught off guard during sudden dramatic changes. It’s not about betting against or shorting these companies, but instead being sure to look under the hood of what investors have across these portfolios and begin a process of diversification.

“With ETFs, we do believe in a reversion to the mean,” Dhillon states. “We do believe in a reversion to the mean over time that is something that has proven in investing over and over again. And we do stress the importance of diversification because that is one thing you can control.”

For more market trends, visit ETF Trends.